Why we still believe in the Magnificent Six over the Magnificent Seven stocks

Revisiting the case for the 'Magnificent Seven' stocks

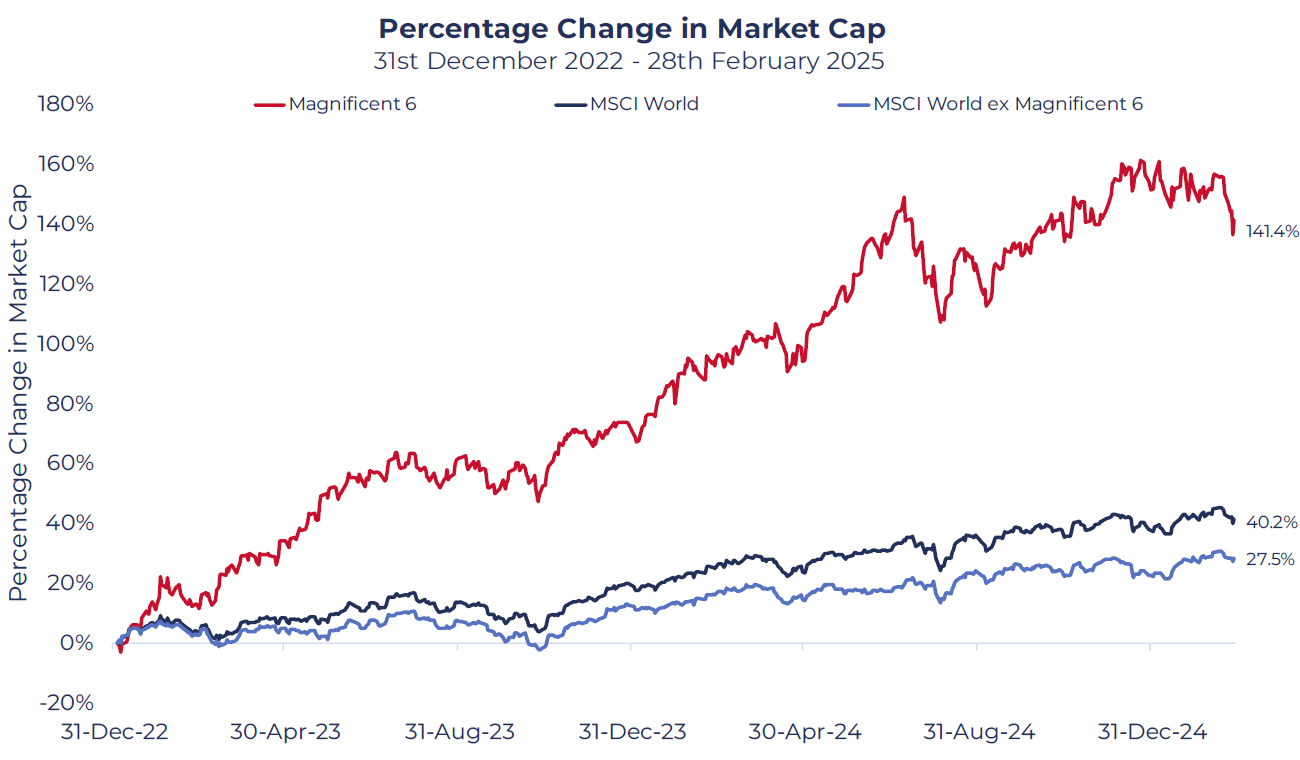

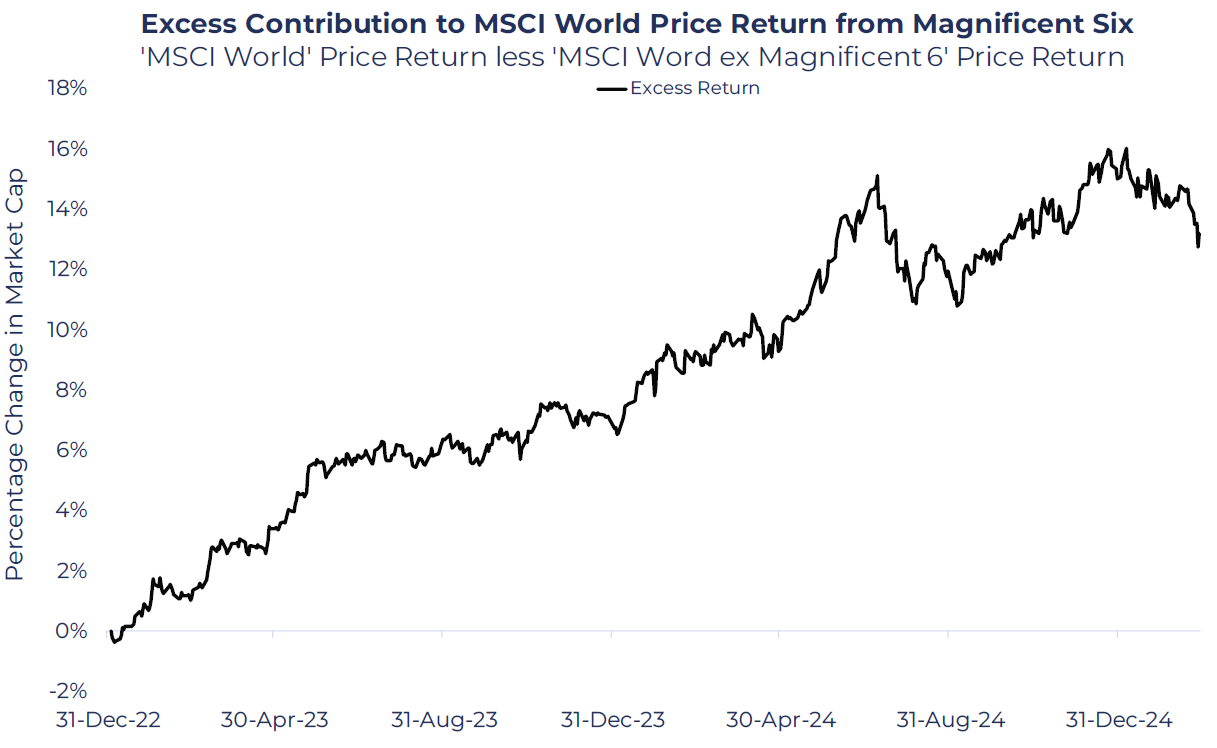

Within the Guinness Global Innovators Fund, we hold six of the ‘Magnificent Seven’ stocks: Apple, Amazon, Alphabet, Meta, Microsoft and Nvidia. We believe these are high-quality, growth stocks at attractive valuations. The sole ‘Magnificent Seven’ stock that we do not hold is Tesla, a company that we perceive as lower-quality and with significant valuation risk. Since the end of 2022, the ‘Magnificent Six’ (the Magnificent Seven excluding Tesla) have seen stark outperformance relative to the MSCI World, contributing to around one-third of the MSCI World’s increase in market capitalization over the period.

Source: Guinness Global Investors, MSCI, Bloomberg, 28.02.2025

The chart below highlights the ‘excess return’ to Index price return that has been contributed by the Magnificent Six since the end of 2022. Over the period, outperformance has been relatively consistent, but since the beginning of 2025, this period of ‘market leadership’ has seemingly stalled. Five of the six stocks have delivered negative returns year-to-date, versus the MSCI World’s 2.5% price return. Inevitably, many market participants have suggested that the era of Magnificent Seven dominance is over. Despite continued solid financial performance in company earnings, investor concerns have focused on future growth prospects and a further ramp-up in datacentre/AI capex (capital expenditure) spend, and there have been familiar claims of elevated valuation risk. After such a significant run over the past two years, the sustainability of such outperformance will naturally come into question, with valuation consistently cited as a reason against holding the Magnificent Seven. Whilst outperformance versus the Index has been relatively consistent over the past couple of years, this is not the first time that markets have called the end of such dominance, with a period of underperformance also coming mid-way through last year – before these losses were eventually regained in the remainder of 2024.

Source: Guinness Global Investors, MSCI, Bloomberg, 28.02.2025

But are the Magnificent Six stocks too expensive for investors?

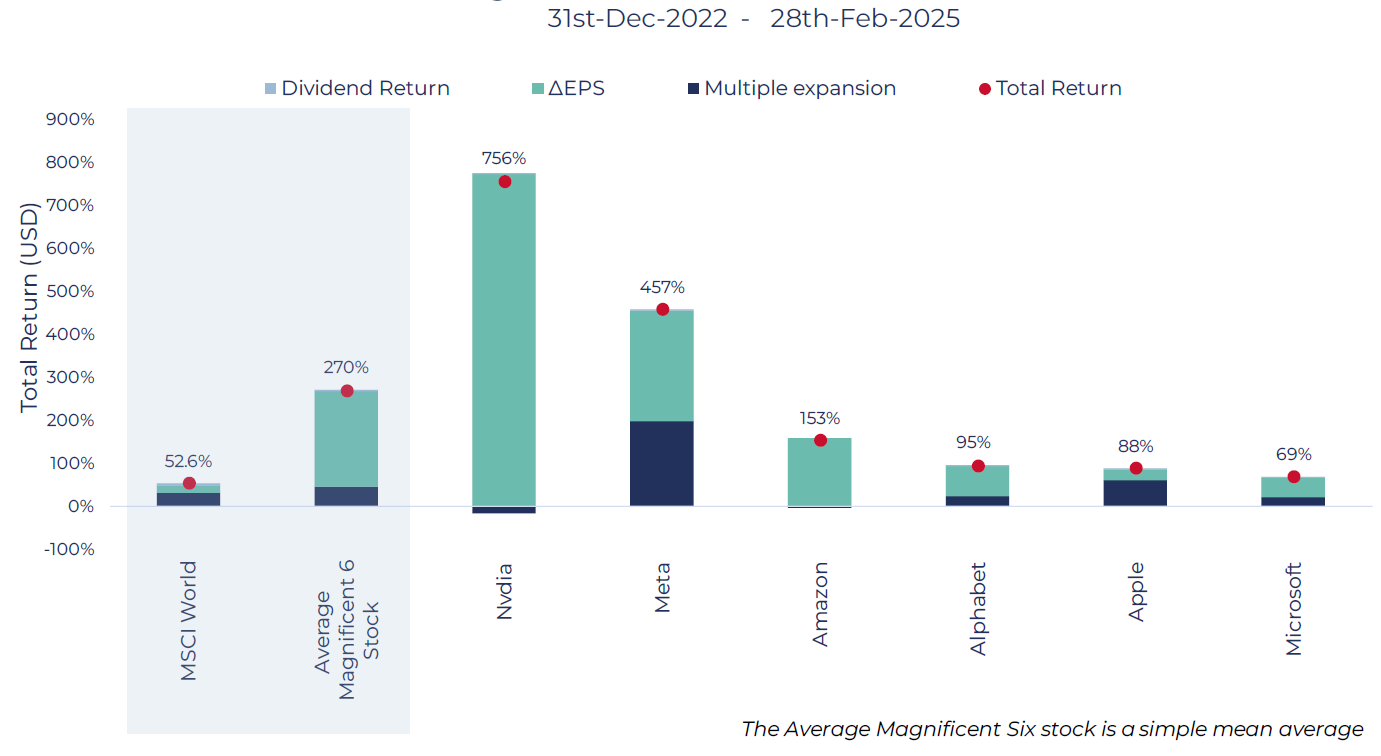

This period of outperformance has been driven predominantly by earnings growth, with valuation expansion playing a relatively minor role. The average (simple mean) Magnificent Six price return over the period was 239%. Of this, 192% came from expected earnings growth (1 yr blended forward), with a 45% contribution from multiple expansion (price/earnings (P/E) 1 yr blended forward). Therefore, multiple expansion has contributed to just a fifth of Magnificent Six returns over the period – this is compared to the MSCI World Index, which saw multiple expansion of 31% accounting for nearly three-fifths of benchmark returns.

If we exclude Nvidia - which had super-normal earnings growth over the period and thus skewed the earnings growth number upwards - even then, only two-fifths of returns can be explained by multiple expansion. In fact, only two of the six saw multiple expansion at a rate ahead of the index: Apple and Meta. In both cases, we would argue that this is a result of both firms becoming fundamentally better companies over the period and thus deserving this multiple expansion. At the end of 2022, Apple was amidst a downturn in the smartphone market, but continued to see strength in Services, continually shifting its earnings mix towards this far higher-quality earnings stream. Meta, on the other hand, has significantly improved cost discipline following a “Year of Efficiency” but has also seen improvements in customer engagement, resulting in a higher-growth business with far higher margins and free cash flow generation.

Magnificent Six Total Return Breakdown

Source: Guinness Global Investors, MSCI, Bloomberg, 28.02.2025

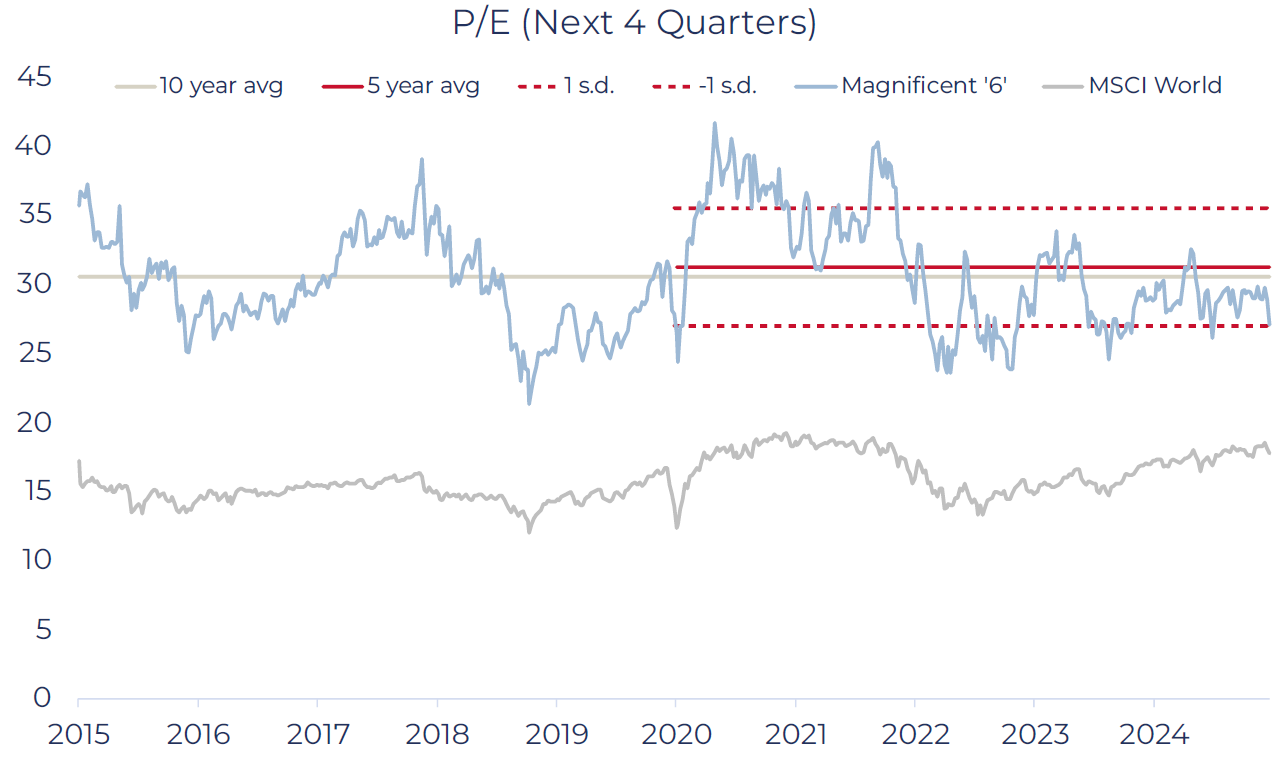

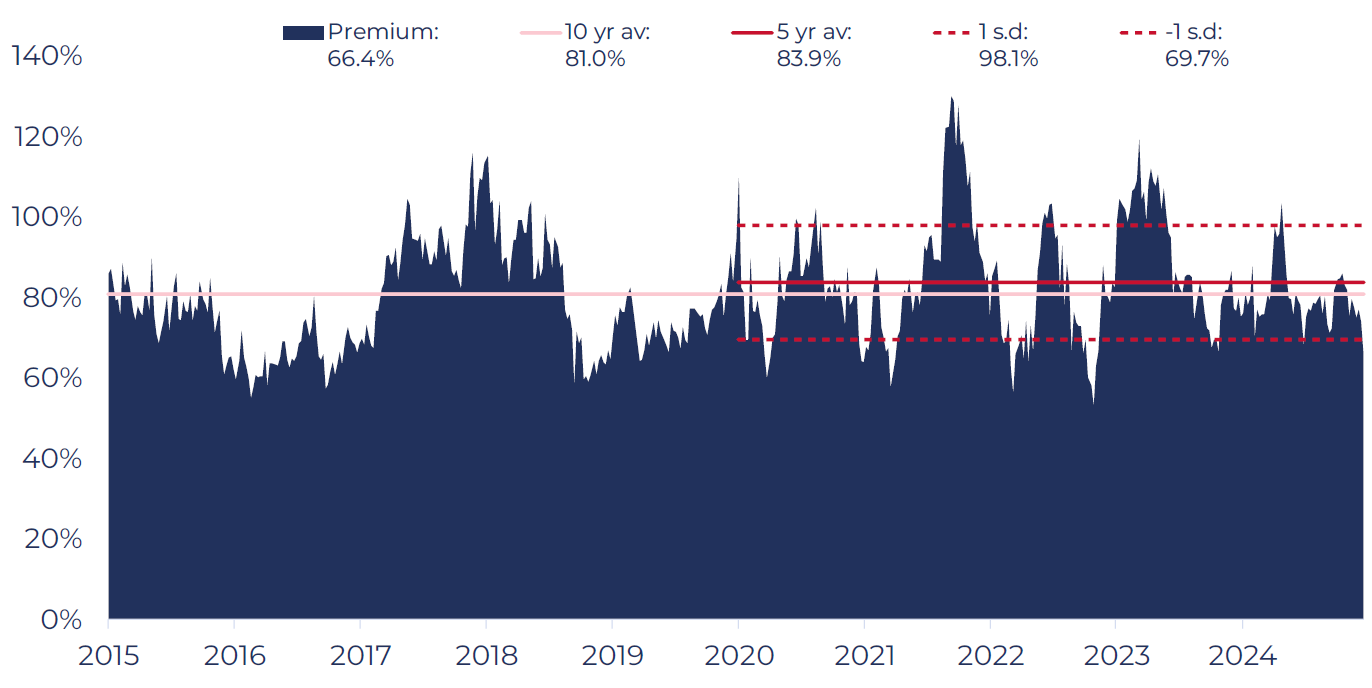

Taking a longer-term view and looking solely at valuation (P/E multiple 1 yr blended forward), the average (simple mean) Magnificent Six stock has a valuation that is around 1 standard deviation below long-term historical averages – an indication that these stocks may be at a discount relative to their own history.

Magnificent Six (Magnificent Seven ex Tesla) Vs MSCI World

Source: Guinness Global Investors, MSCI, Bloomberg, 28.02.2025

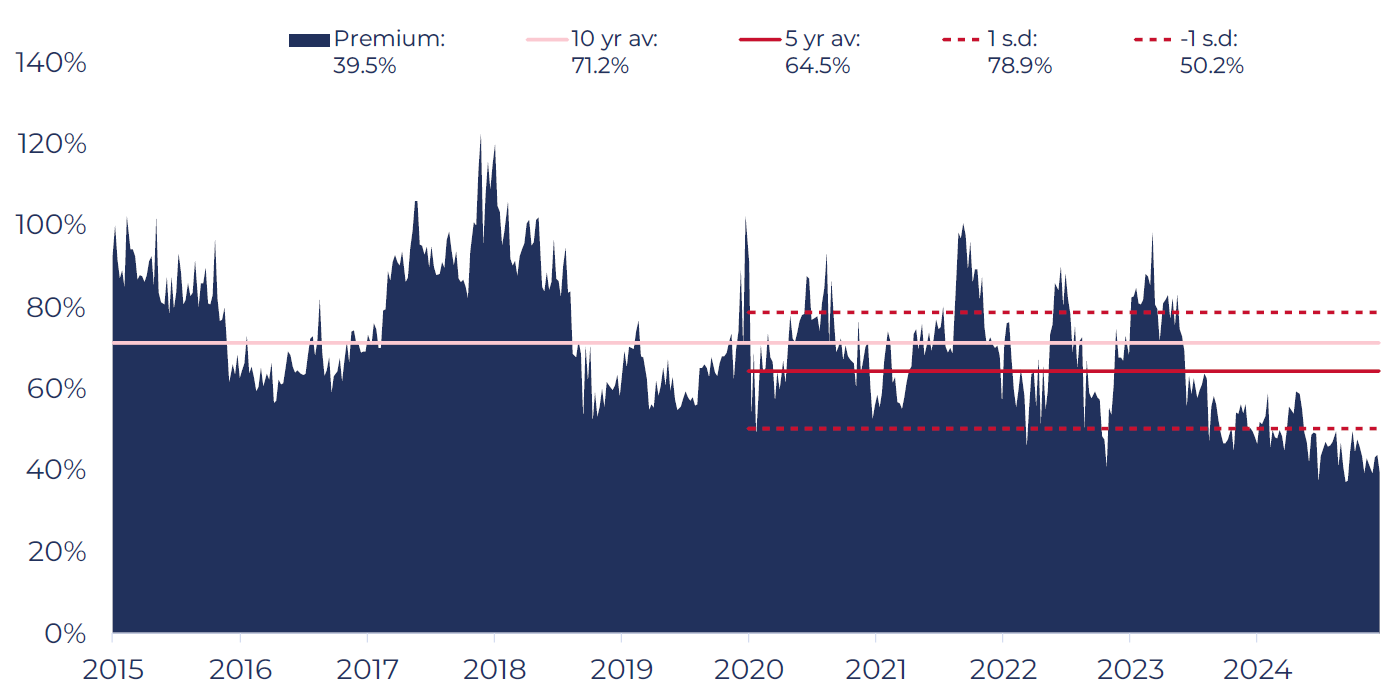

Comparing this to the market, these stocks have typically traded at a significant premium to the market – between 65/71% on 5/10-year averages. Currently, these stocks are trading at a premium of 40%.

'Magnificent Six' Premium Vs MSCI World

Source: Guinness Global Investors, MSCI, Bloomberg, 28.02.2025

Of course, these companies now account for a far greater weighting of the index than ever and will therefore be pulling up the index valuation against which we are comparing them. Therefore, the premium to the market will naturally come down. But we can adjust for size effects by observing the premium relative to the MSCI World Equally Weighted Index. Even in this fairer comparison, the premium is a standard deviation below the long-term average.

'Magnificent Six' Premium Vs MSCI World Equally Weighted

Source: Guinness Global Investors, MSCI, Bloomberg, 28.02.2025

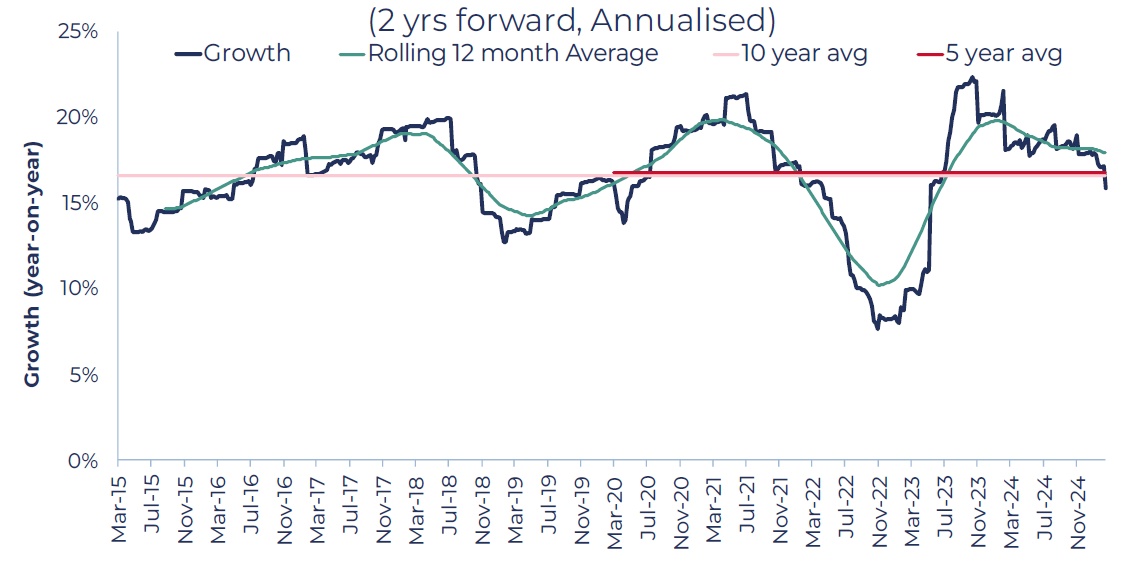

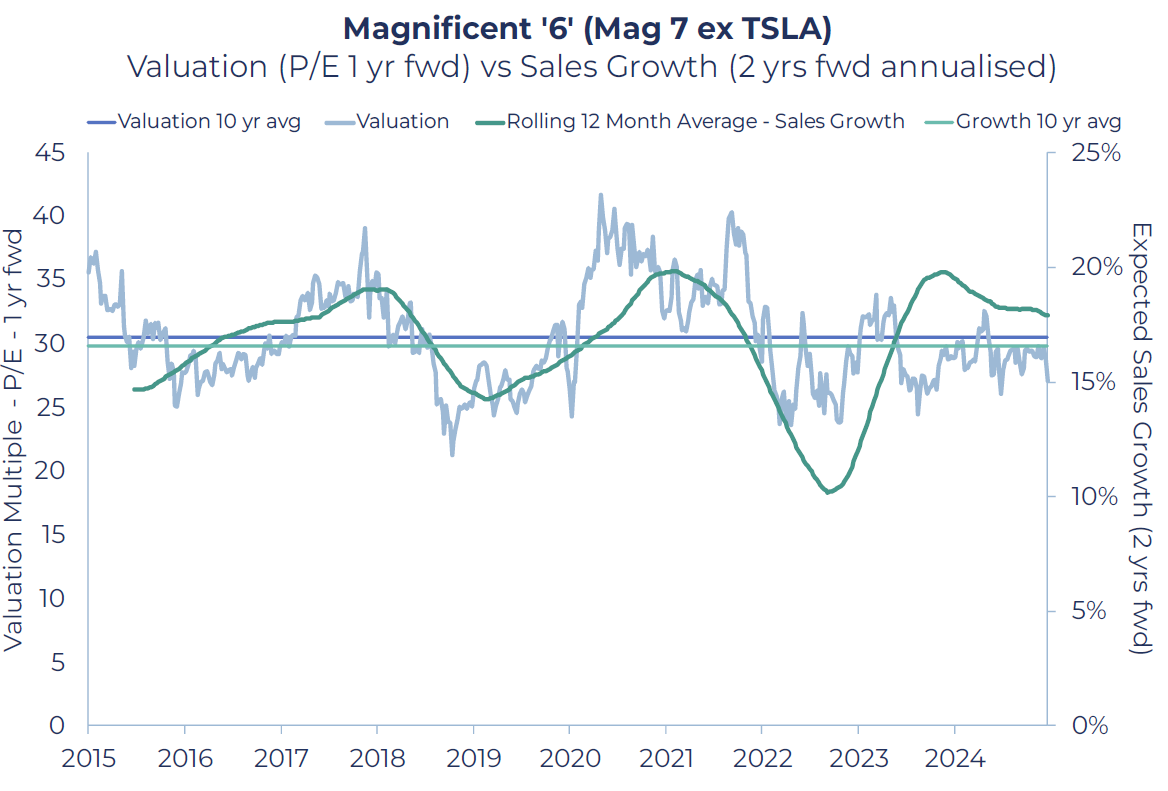

So these stocks are no more expensive than they have been, on average, over the past 10 years, and are even slightly cheaper than they have been relative to the index. But perhaps the growth outlook of these businesses has diminished, making concerns of elevated valuations may be justified? On average, we find that short-term growth expectations for these stocks are little different to what they have been over the past 10 years (the long-term outlook requires a more qualitative approach, which we will take later). Expected sales growth (2 years blended forward) is relatively in line with both 5 and 10-year averages.

Magnificent Six - Revenue Growth Expectations

Source: Guinness Global Investors, Bloomberg 28.02.25. Rolling 12-month average is an average of 6 months back, 6 months forward.

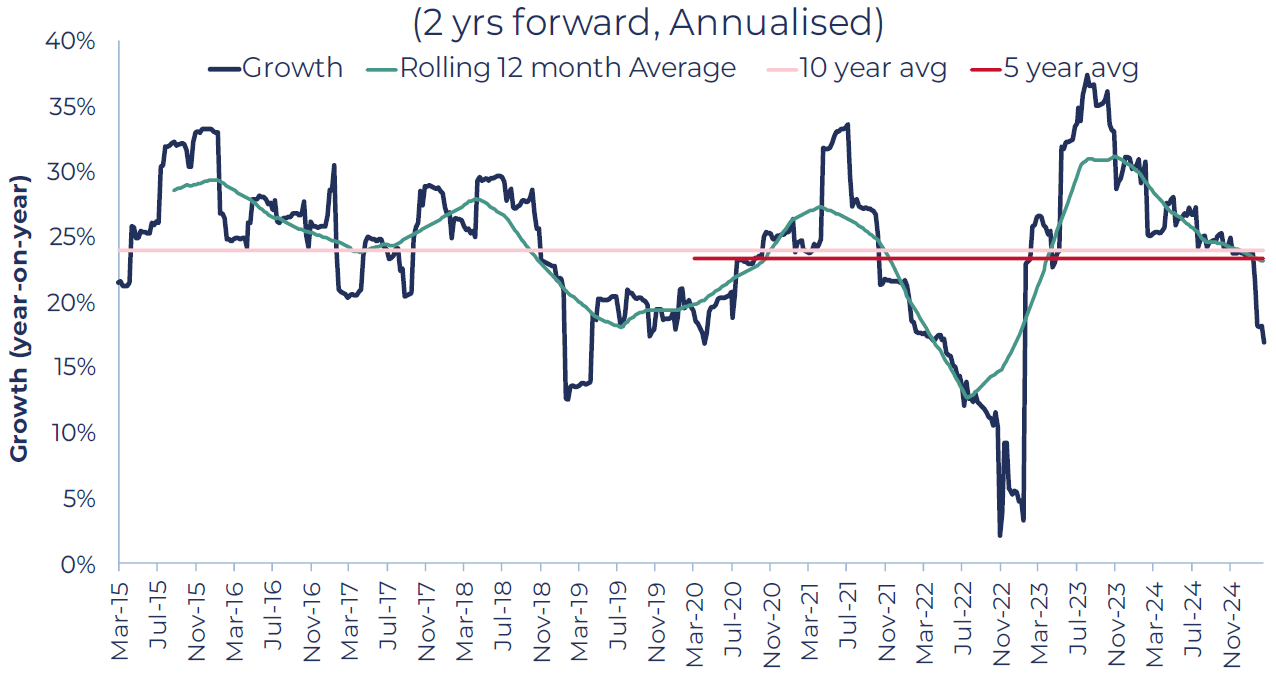

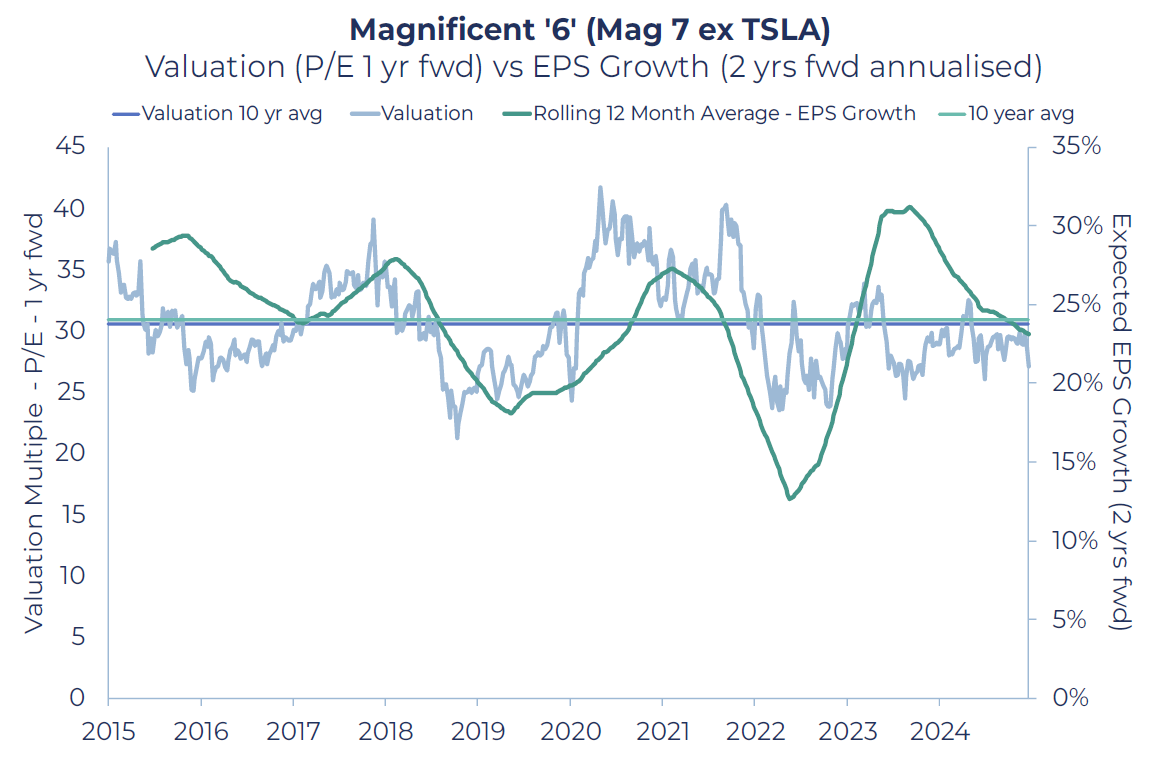

Granted, earnings per share (EPS) expectations have fallen significantly over the first two months of 2025, but are not wildly different from the average, and are more likely simply a result of ‘noise’ in the market rather than any fundamental shift in the investment thesis for these stocks. In fact, the 12-month average is exactly in line with the long-term average

Magnificent Six - EPS Growth Expectations

Source: Guinness Global Investors, Bloomberg 28.02.25

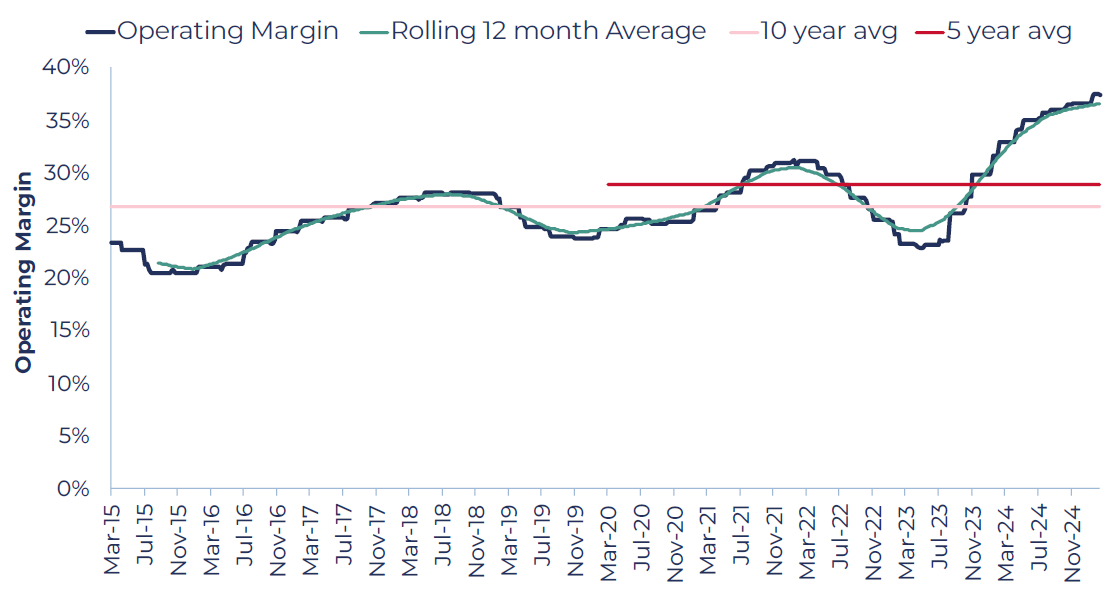

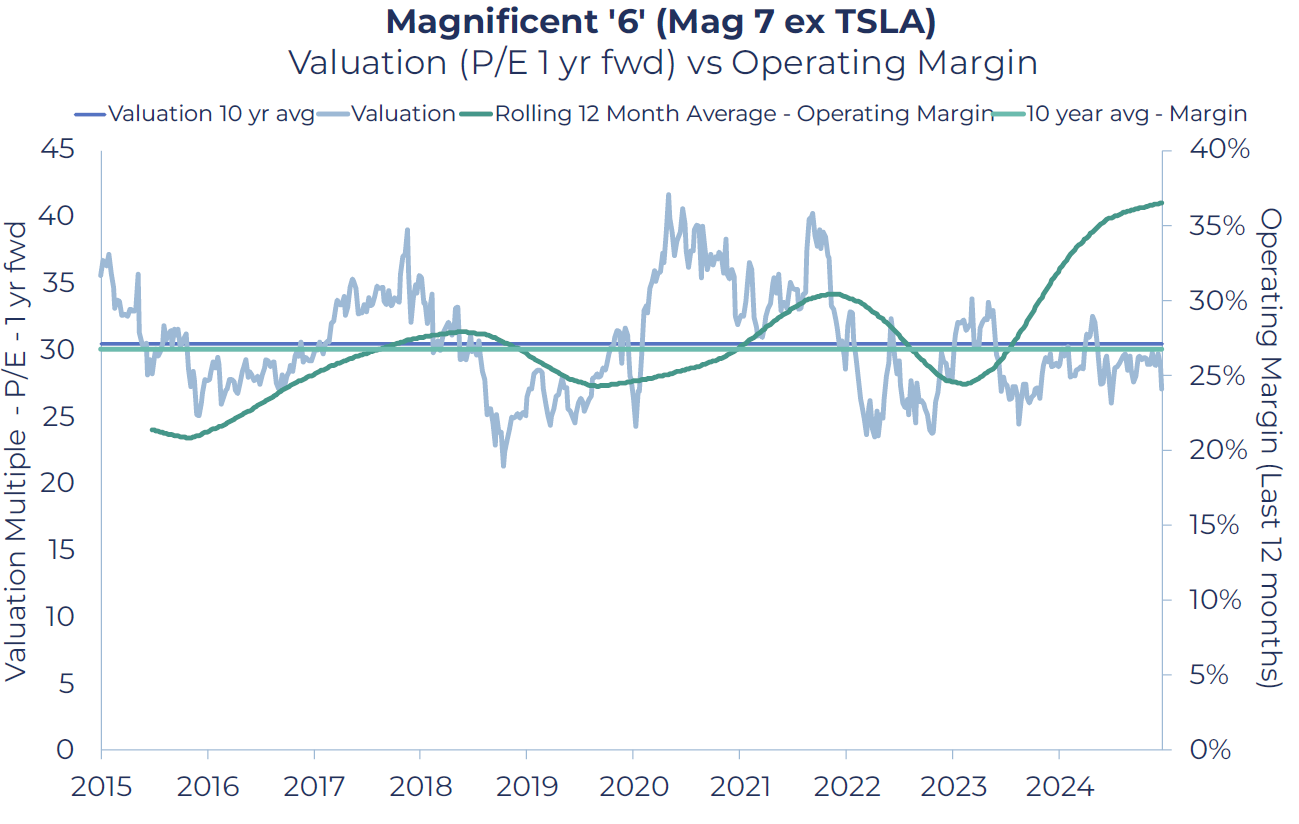

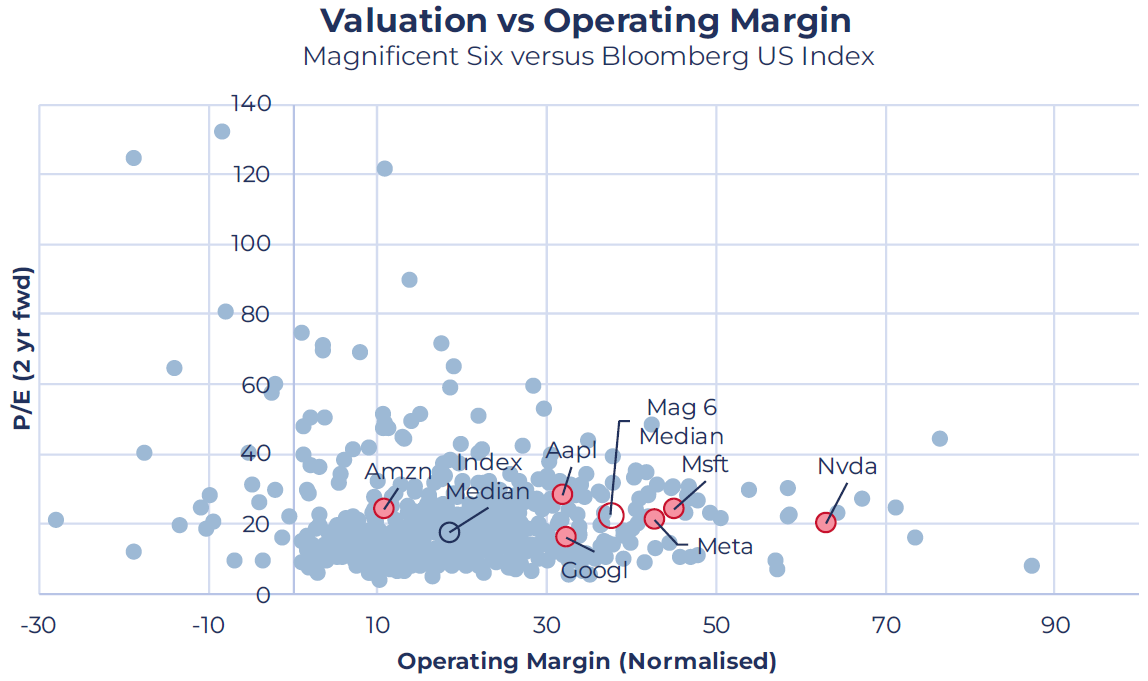

Valuations, then, do not look out of line with history and growth expectations are similar to what we have seen over the past 10 years. Could claims of over-valuation be made on quality grounds? That is, have the underlying businesses deteriorated, making them worse value than before? We don't think so. We believe that these firms are arguably far higher quality than at any point in the previous 10 years. Operating margins have been trending upwards and are now, on average, significantly ahead of long-run averages.

Magnificent Six - Average Operating Margin

Source: Guinness Global Investors, Bloomberg 28.02.25

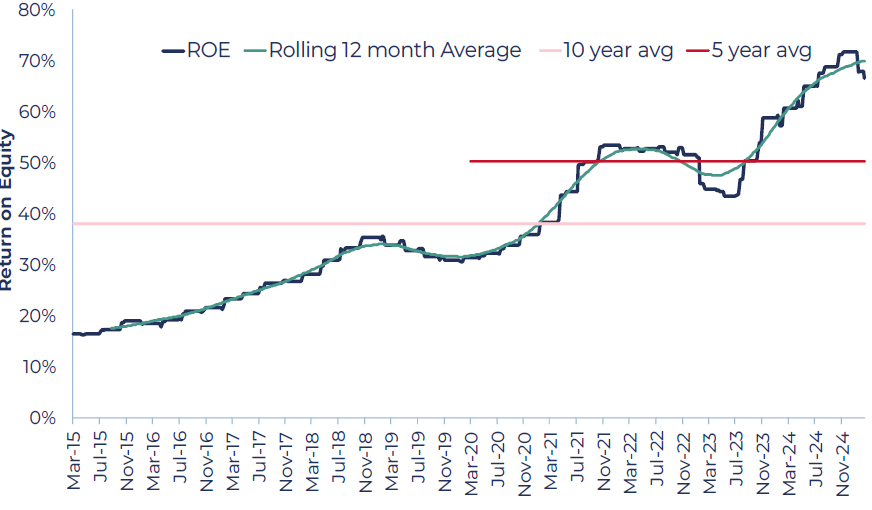

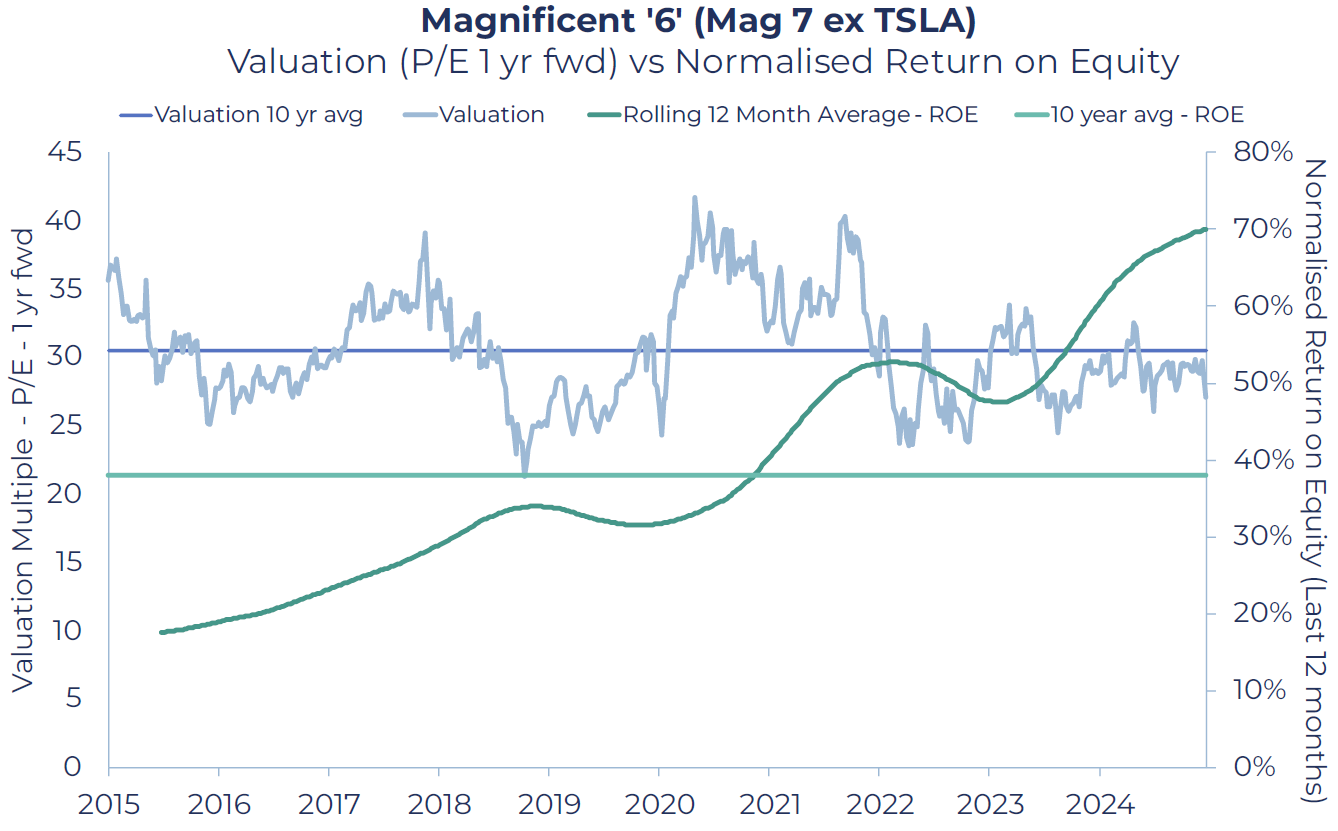

And return metrics have been trending upwards at an even faster rate.

Magnificent Six - Average ROE (Return On Equity) (Normalised)

Source: Guinness Global Investors, Bloomberg 28.02.25

Valuations for the Magnificent Six stocks over the last 10 years

Plotting all these metrics versus valuation helps to bring the point home. We have used the 12-month rolling average to remove noise from the charts. Although the Magnificent 6's valuations are below long-run averages (and at a similar premium to the index on an equally weighted basis)...

Sales growth (2 years forward, rolling 12-month average) expectations are ahead of long-run averages.

Source: Guinness Global Investors, Bloomberg 28.02.25

And EPS growth expectations (2 years forward, rolling 12-month average) are in-line.

Source: Guinness Global Investors, Bloomberg 28.02.25

Operating margins (rolling 12-month average) are significantly ahead of long-run averages…

Source: Guinness Global Investors, Bloomberg 28.02.25

…and so is Return on Equity (normalized, rolling 12-month average).

Source: Guinness Global Investors, Bloomberg 28.02.25

Are the Magnificent Six stocks overvalued?

The Magnificent Six, on average, have a valuation that is 1 standard deviation below the long-run average over the past 10 years, and have one of the smallest premiums to the Index in recent history. This is despite having a similar growth outlook to history, and far superior quality metrics. So although some may claim that the Magnificent 6 are overvalued, on a group level, we don’t find much evidence to support this. We are unconcerned with short-term fluctuations in the growth outlook (although we will of course monitor them) because, first, growth expectations are typically noisy, secondly, the these businesses have a long history of innovation reigniting the topline, and thirdly, we know they compete in rather cyclical end-markets. Given the significant improvements in ‘quality’ – a factor that we have found to be persistent over long periods – we believe these stocks may in aggregate be as attractively valued as ever.

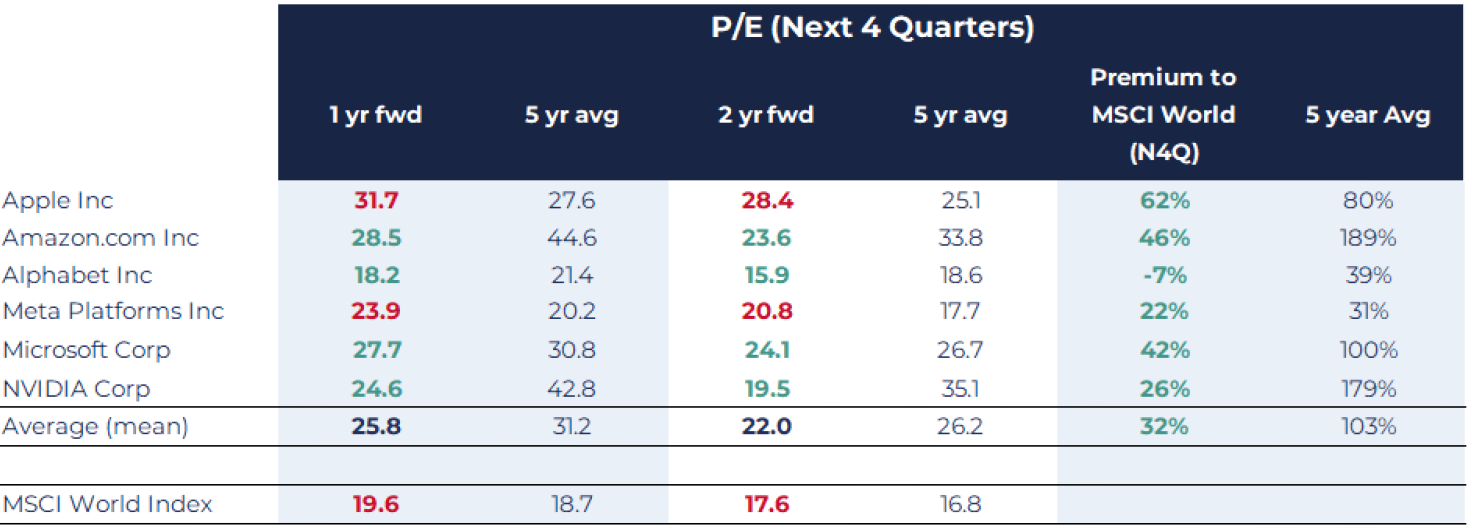

There are substantial shortcomings in analysing metrics of group statistics – the most obvious being that clearly the ‘average’ is not true for each stock, and we certainly shouldn’t take averages at face value. Whilst group statistics may be indicative of a broader trend, the individual figures are far more varied and need to be contextualised before coming to any conclusions. Individually, only two of the six – Apple and Meta – have a 1 yr forward P/E ahead of their 5-year averages, but still remain below their average premium to the market.

Source: Guinness Global Investors, MSCI, Bloomberg – date at 28th February 2025

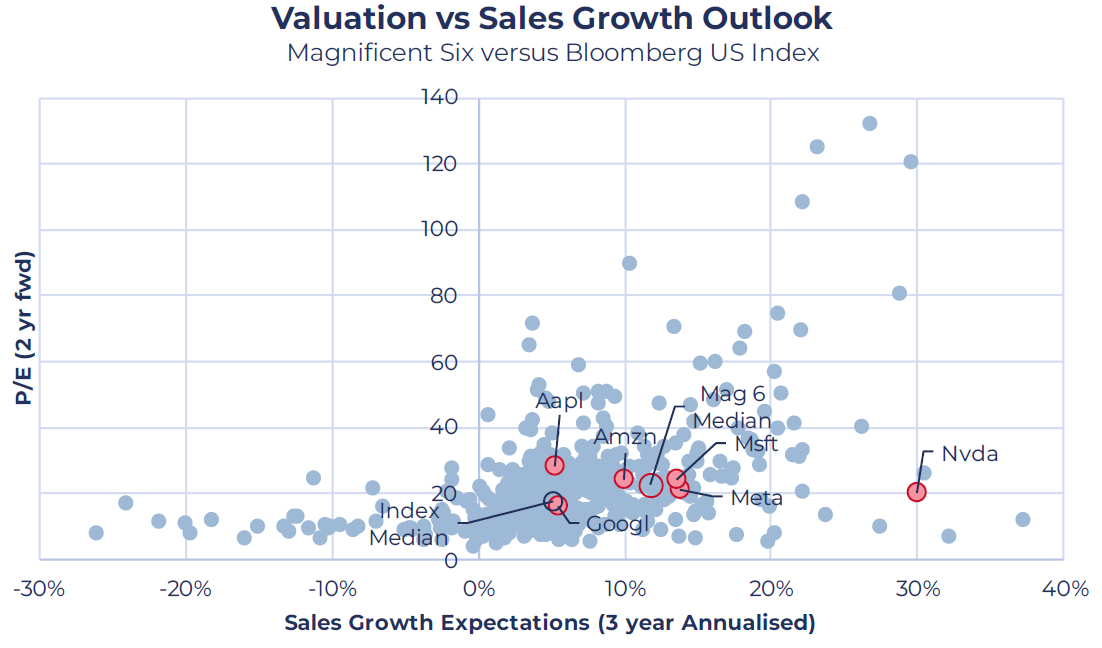

Plotting the Magnificent Six stocks individually

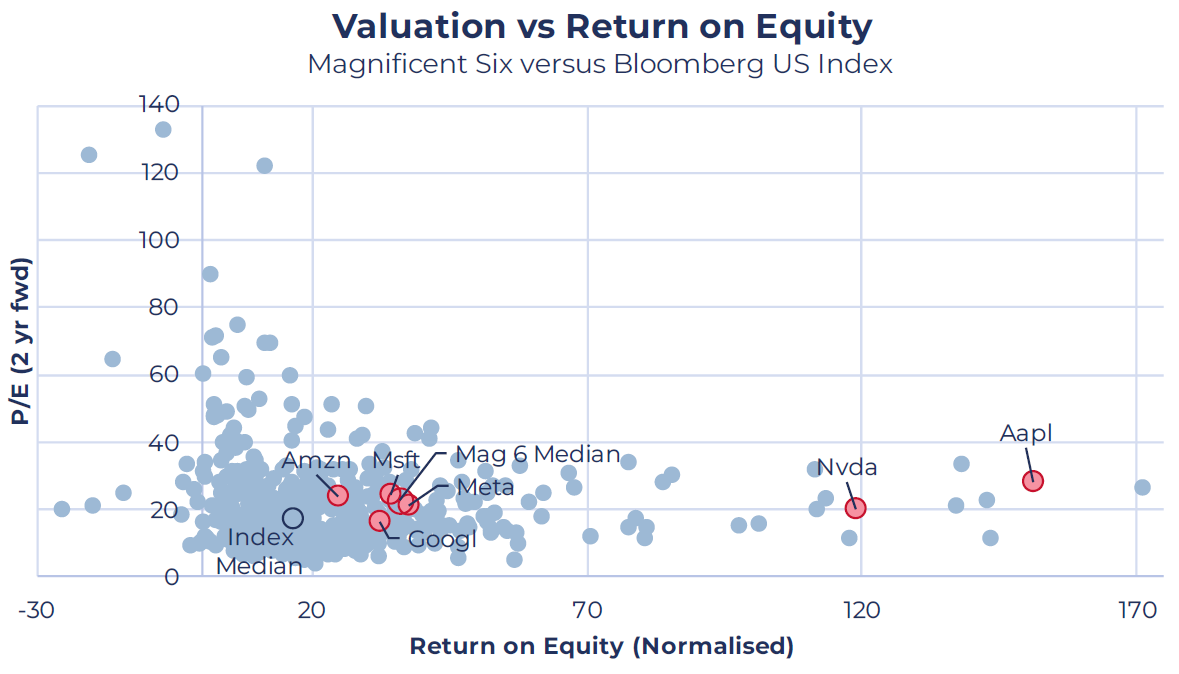

Looking at these stocks individually, we can see that all Magnificent Six stocks have sales expectations at least in line with the average of other US stocks (The Bloomberg US Index is a good proxy for the S&P 500). For valuation, we have used P/E (Price/Earnings) with 2-year forward estimates, given that these stocks are likely ‘growthier’, and a shorter-term outlook will not fully capture the expected growth trajectory. Whilst most are valued at a premium to the index (except Alphabet), none are at extreme valuations that would cause concern.

Source: Guinness Global Investors, Bloomberg 28.02.25

Except for Amazon, these Magnificent Six stocks are also typically higher margin…

Source: Guinness Global Investors, Bloomberg 28.02.25

…and with a higher return on equity (we have used Return on Equity rather than our preferred Return on Capital metric, since data for the index is patchier for Return on Capital).

Source: Guinness Global Investors, Bloomberg 28.02.25

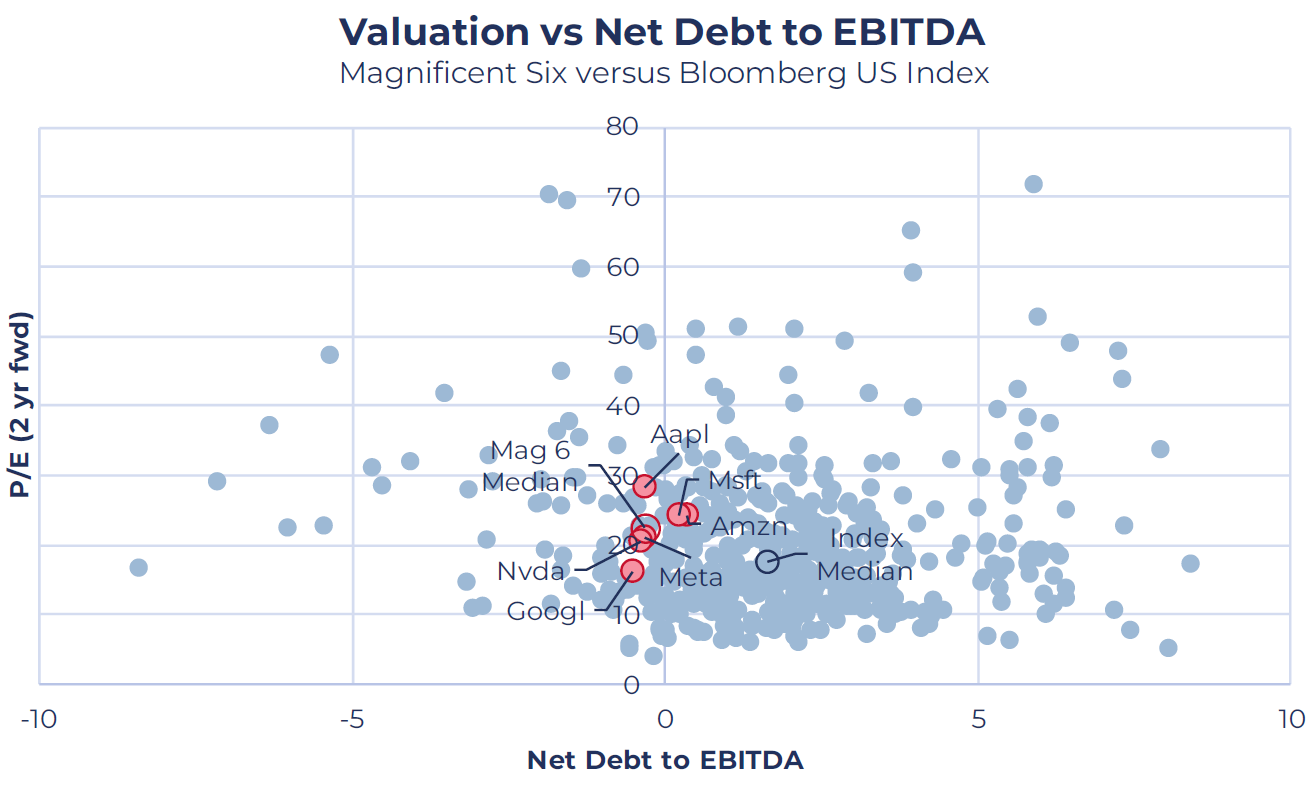

Finally, these Magnificent Six stocks also tend to have much stronger balance sheets, all with a Net Debt to EBITDA of below 0.5x – with most who are even net cash.

Note, for this chart, there are a number of Index stocks outside the bounds of the axes. However, we have scaled the axes to improve the overall picture.

Source: Guinness Global Investors, Bloomberg 28.02.25

How Magnificent Six stocks have diversified their revenue streams in recent years

With stronger growth outlooks and fundamentally higher quality financial profiles, the Magnificent Six are seemingly deserving of a valuation premium to the wider market. Of course, relying solely on individual financial metrics provides only a partial view of their long-term investment case. Whilst these metrics may be informative over the short term, a more comprehensive assessment over a 3–5 year investment horizon (such as that of the Fund) requires a more qualitative view. Although we have found ‘quality’ to be a more persistent factor over longer time horizons, growth can be far more volatile and difficult to predict. Financial metrics provide useful signals for shorter-term expectations, but they do not capture the full picture of what will ultimately drive share price performance over the longer term. Below, we take a look at these stocks from a more qualitative perspective.

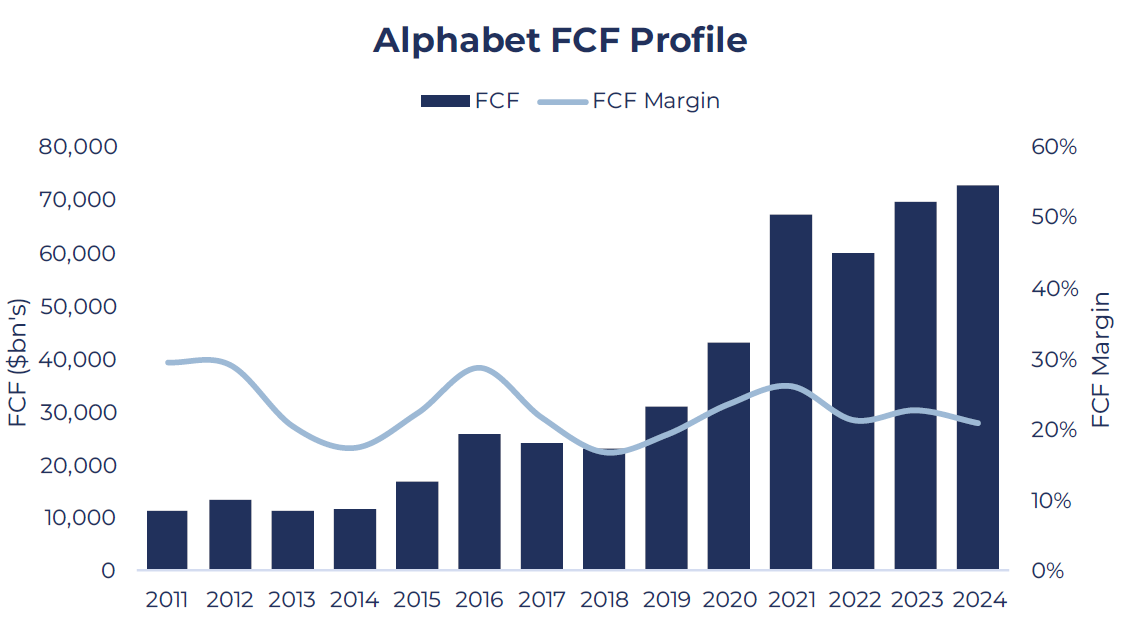

Alphabet has long dominated the search engine and digital advertising markets, with a near 90% market share in search engine volumes and near 40% share in digital advertising, allowing the firm to leverage a trove of proprietary data to maintain its leadership. However, the company is successfully transitioning into a more diversified, high-growth business with increased contributions from Cloud and AI-driven services, while continuing to enhance its core advertising segment. Despite cyclical fluctuations in digital ad spending, Alphabet has demonstrated resilience through consistent innovation, monetisation of new ad formats, and an expanding ecosystem of paid services, driving strong Free Cash Flow (FCF) growth over the past decade – whilst maintaining a relatively high and steady FCF margin. Google Cloud, an increasingly profitable segment, is positioned as a key top-line growth driver, projected to grow at above 20% for the next three years at least, as businesses accelerate their cloud and AI adoption.

Alphabet’s recent AI-driven initiatives, including Gemini and its Search Generative Experience (SGE), have the potential to drive higher engagement and further advertising monetisation over time. Additionally, YouTube’s premium subscriptions and continued ad revenue growth (supported by a shift toward connected TV and ‘Shorts’ monetisation) further diversify the revenue base. While regulatory scrutiny and competitive pressures in AI remain risks, Alphabet’s vast data advantage, entrenched user base and continued innovation provide a compelling case for sustained growth and cash flow generation.

Source: Guinness Global Investors, Bloomberg, Company Data, 28.02.2025

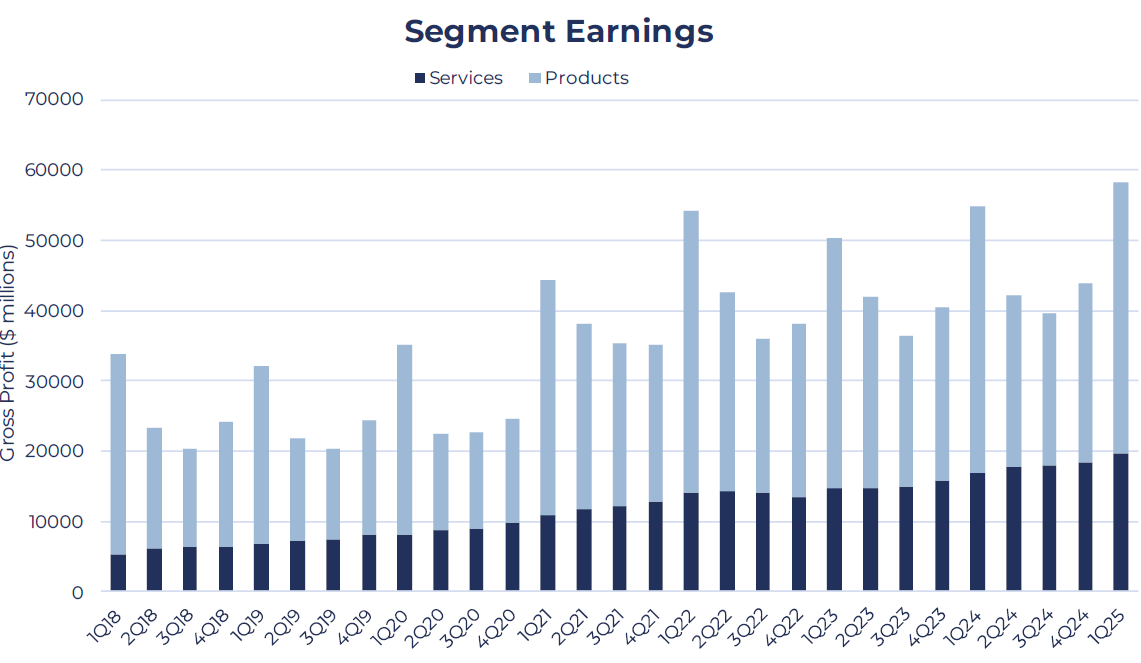

Apple has successfully been shifting its revenue/earnings mix towards Services - a higher-growth, higher-quality recurring earnings stream – and dampening the impact of cyclical product sales on profitability. In recent years, Apple has been amidst a cyclical trough in iPhone demand, but the firm has been executing well in a declining smartphone market – holding unit sales steady but growing the overall ‘installed base’ of Apple Product users at a rate of 10% (2016-2025). This has created a fast-growing end-market for Apple to sell ‘Services’ to (e.g. storage, music, etc) – a stickier, less cyclical and higher-margin business (twice the gross margin of hardware products), that now accounts for 40% of earnings.

iPhone (and Apple hardware products more generally) remain a significant growth opportunity, and is in some senses a recurring revenue stream in itself, as a loyal customer base (over 90% retention) habitually upgrades their handsets. Long-term share gains and increasing penetration in emerging markets will not only grow iPhone, but drive growth in the installed base to which Apple can sell further recurring Services products. Not only do we expect a continued shift in revenue mix to make what is already a very high-quality company even higher-quality, we see a number of growth opportunities for the firm, including continued price increases in iPhone, greater penetration of subscribers to ‘Services’ within the growing installed base, continued market share gains (particularly in emerging markets), and a cyclical upswing in hardware (with products currently in emerging from trough).

Source: Guinness Global Investors, Bloomberg, Company Data, 28.02.2025

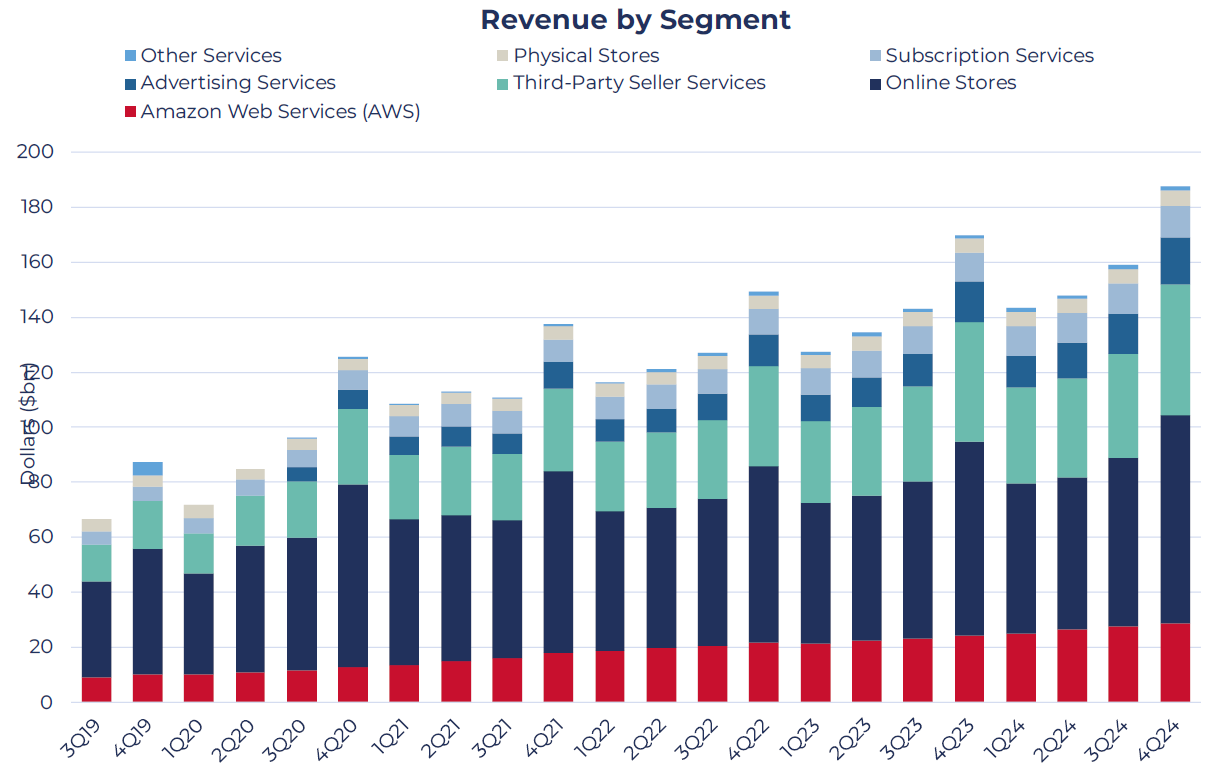

Amazon is a high-quality, high-growth business with a wide economic moat, underpinned by its leadership in e-commerce, cloud computing, and digital advertising. The company continues to outperform expectations across multiple fronts, delivering strong revenue growth, expanding margins, and improving capital efficiency. Its three largest segments – Online Stores, Third-Party Seller Services, and AWS – grew by 7%, 11%, and 19% in 2024 respectively, an impressive achievement given Amazon’s scale. Amazon’s crown jewel, AWS, remains a key growth driver, benefiting from capacity-constrained demand and the rapid adoption of generative AI, prompting management to accelerate investment in datacentre expansion.

Meanwhile, Amazon’s advertising business is scaling rapidly, consistently outpacing major internet peers, leveraging deep consumer insights to drive engagement and monetisation. Beyond its top-line momentum, Amazon has shown strong operational execution, with operating margins reaching an all-time high of nearly 11% in 2024, as the company continues to unlock efficiencies through its multi-hub logistics strategy and increased automation. With management forecasting double-digit revenue growth for the foreseeable future and further margin expansion through the increasing earnings mix towards AWS (and lower growth of lower-margin business more generally), Amazon is exceptionally well-positioned to sustain its trajectory as a dominant force in global commerce and technology.

Source: Guinness Global Investors, Bloomberg, Company Data, 28.02.2025

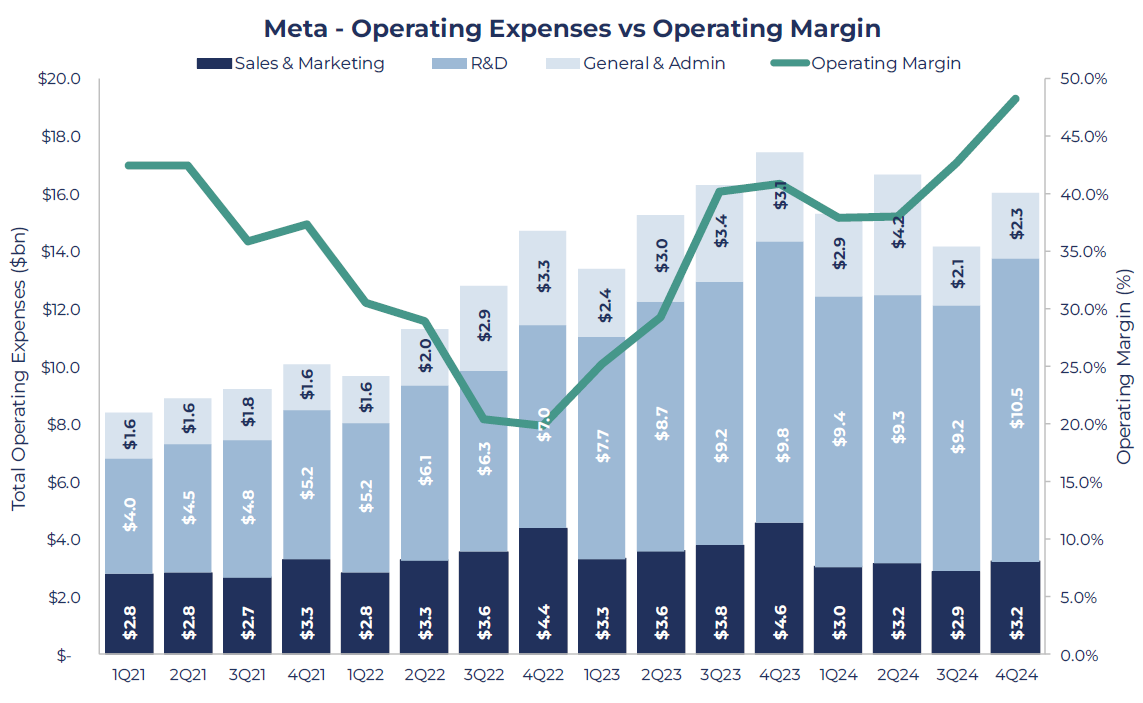

Meta has built a dominant advertising business that has leveraged a vast trove of user data to deliver highly targeted digital ads across its family of apps. Despite cyclical fluctuations in ad spending, Meta has demonstrated strong growth as it successfully executes on improving user engagement and monetisation of new revenue streams. Following investor pushback in 2022, the company shifted its focus toward cost efficiency, including significant headcount reductions and disciplined capital allocation. This led to a substantial margin expansion – with the firm more than doubling operating margins from 20% in 4Q22, to 48% in 4Q24 – an all-time record for the firm and a clear example of the underlying quality inherent to the business model.

While Meta’s core Family of Apps segment remains the primary driver of revenue and profitability, new monetisation opportunities are emerging. AI-driven ad targeting, WhatsApp Business monetisation, Click-to-Message ads, and growing engagement with Reels were all initially ‘side-bets’, but are increasingly contributing to the firm’s healthy growth outlook. Reality Labs, while still a drain on profitability, is offering visibility towards a significant source of new revenue. Currently with a $2bn revenue rate, this segment has the potential to become a significant contributor to revenue mix if monetised effectively. Meta has proven in the last couple of years its ability to be a high-quality compounder, with significant cash generating ability (FCF margins to above 30%). With the core of the business growing by double digits and a number of heavily investment growth avenues, we expect Meta to maintain long term strong top-line growth.

Source: Guinness Global Investors, Bloomberg, Company Data, 28.02.2025

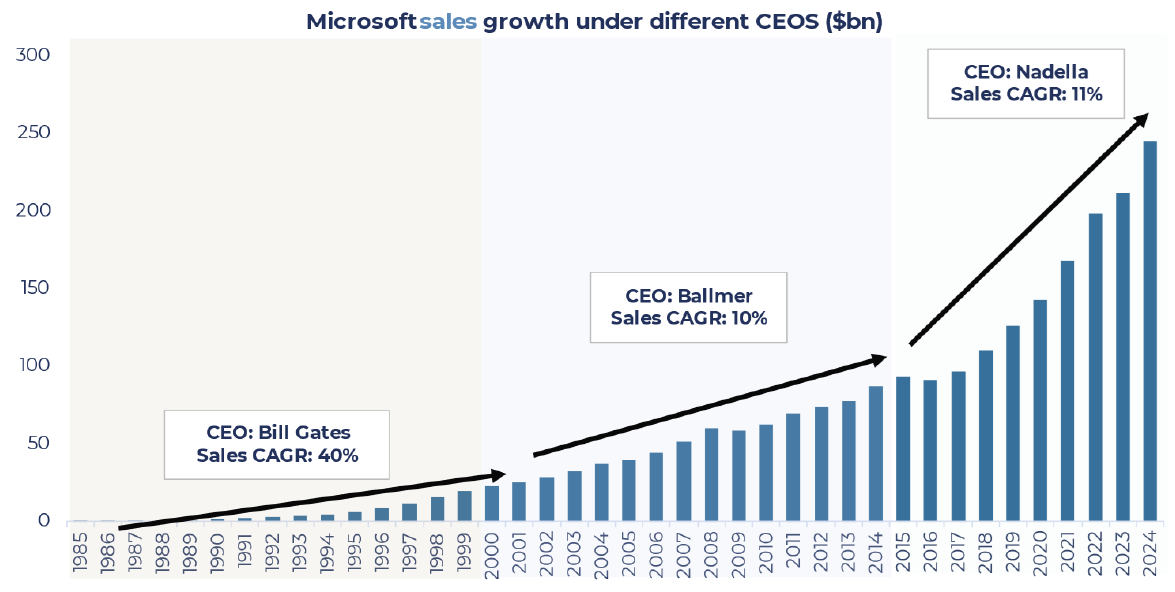

Microsoft has arguably one of the best mixes of quality growth businesses in the opportunity set, with all three core business segments growing double digits in FY24, from an exceptionally large base. The company’s strategic focus on cloud computing, AI and enterprise software has propelled it into one of the highest-quality, high-margin growth stories in technology. The predominant driver of group growth has been (and is expected to continue being) Azure, Microsoft’s cloud offering, which has been delivering c.30% growth as structural demand has taken hold, although the firm has also been taking share from market leader Amazon’s AWS due to Azure’s unique hybrid-cloud offering. And as ‘Cloud’ accounts for an increasing percentage of the firm’s revenue mix, this has allowed operating margins to trend consistently upwards.

While near-term capex requirements for cloud and AI infrastructure may weigh on margins, Microsoft’s ability to drive expansion in average revenue per user (ARPU), achieve scale efficiencies within cloud, and achieve continued growth in high-margin enterprise software can help mitigate this impact. Free Cash Flow has grown at an annualised rate of 10% since 2019, demonstrating significant profitability with FCF margin stable at around the 30% mark. Alongside a strong balance sheet, disciplined capital allocation (including growing dividends and steady buybacks), and a diversified revenue base, Microsoft remains well positioned as a high-quality leader in enterprise technology, cloud, and AI innovation, with the quality-growth mix one of the most attractive in the investment universe. The firm has a long history of exceptional top-line growth across periods and across management teams, and is a best-in-class example of a company that is continually able to innovate and drive growth.

Source: Guinness Global Investors, Bloomberg, Company Data, 28.02.2025

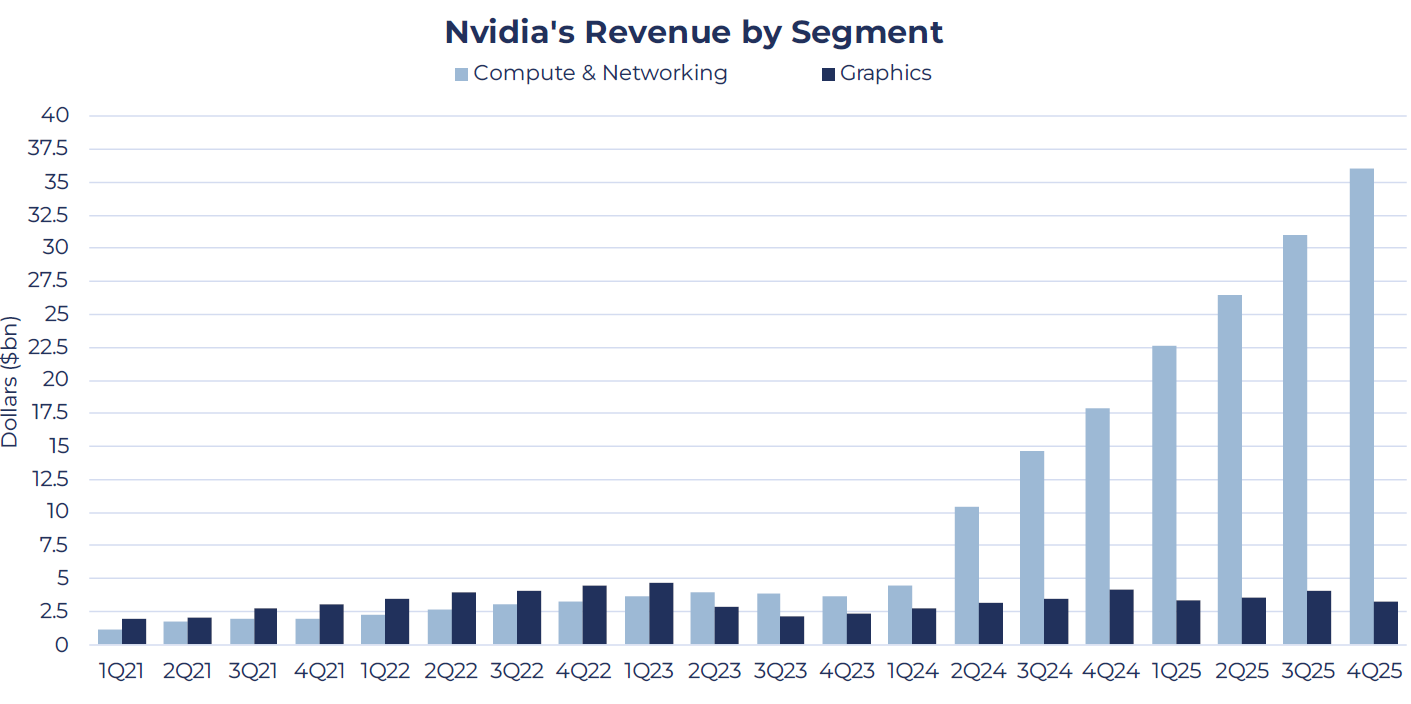

We have held Nvidia in the strategy since 2003, but in recent years the investment case for the firm has changed significantly. Since the beginning of 2023, Nvidia’s ‘Hopper’ GPUs (Graphics Processing Unit) have been at the centre of exploding demand for chips powerful and efficient enough to facilitate the energy-intensive requirements of AI processes within datacentres. Initially possessing over 95% of market share in these types of chips, Nvidia has been quick to entrench its position as the technological leader in the space, launching Blackwell, the successor to the Hopper GPU, in March 2024 and inhibiting the likes of AMD and Intel from taking meaningful share of the fast-growing market.

Compared to Hopper, which is continuing to fuel Nvidia’s extreme revenue growth, the Blackwell chip is twice as powerful for training AI models and has five times the capability when it comes to “inference” (the speed at which AI models respond to queries). Demand for such chips, particularly from other Magnificent Six firms, has resulted in super-normal revenue and profitability growth. Whilst we do not expect such growth to be sustained, we do expect significant demand to remain as companies invest in upgrading existing data centres and building new ones, with Nvidia well-positioned to capture a significant share of the estimated $2 trillion market opportunity over the next five years. While the emergence of cost-efficient AI ‘training’ models like DeepSeek presents a risk, we believe lower training costs will likely spur much broader adoption of AI applications, and thus driving demand for ‘inference’ (rather than ‘training’). Nvidia already holds a leading position in inference, with roughly 40% of revenue stemming from inference workloads, and we see this as a considerable growth driver for the firm longer term. With AI-driven capital expenditures from big tech showing no signs of slowing down, order cancellations appear unlikely despite evolving AI models.

Further innovation, including the H200 chip, ensures Nvidia’s technological edge extends into 2025 and beyond. Nvidia’s valuation may remain a topic of debate for some, but on our analysis above, we believe it still appears reasonable given its dominant market position, innovative prowess, and exposure to long-term secular growth trends in AI, cloud computing, and data infrastructure. We believe Nvidia remains well-positioned to deliver sustained outperformance over the long term, as a cornerstone of the AI theme.

Source: Guinness Global Investors, Bloomberg, Company Data, 28.02.2025

Which stocks are the next Magnificent Seven?

We use the title 'Magnificent Six' to refer to the Magnificent Seven stocks excluding Tesla, and all six are held in the Guinness Global Innovators Fund. We believe they are high-quality, growth stocks at attractive valuations – exactly the types of stocks we are looking for in the search for long-term capital growth. But under our equal-weight portfolio construction – where each of our 30 stocks has a broadly equal weight to balance concentration with stock-specific risk – they only make up around 20% of the portfolio. The other 80% of the fund is held in stocks in a variety of sectors, but all exposed to secular growth themes and with strong underlying businesses. We think the case for the Magnificent Six remains strong – but as fund managers, we believe the case for adhering to an investment process and disciplined portfolio construction is even stronger.

Find out how we select quality growth stocks for the other 80% of the Guinness Global Innovators Fund.

This is a marketing communication. Please refer to the prospectus, supplement, and KID/KIID for the Fund before making any final investment decisions.

Risk: The Guinness Global Innovators Fund and WS Guinness Innovators Fund are equity funds. Investors should be willing and able to assume the risks of equity investing. The value of an investment and the income from it can fall as well as rise as a result of market and currency movement; you may not get back the amount originally invested. The Funds are actively managed with the MSCI World Index used as a comparator benchmark only. The Funds invest primarily in global equities which provide a yield above the yield of the benchmark (MSCI World Index).

Disclaimer: This Insight may provide information about Fund portfolios, including recent activity and performance and may contains facts relating to equity markets and our own interpretation. Any investment decision should take account of the subjectivity of the comments contained in the report. This Insight is provided for information only and all the information contained in it is believed to be reliable but may be inaccurate or incomplete; any opinions stated are honestly held at the time of writing but are not guaranteed. The contents of this Insight should not therefore be relied upon. It should not be taken as a recommendation to make an investment in the Funds or to buy or sell individual securities, nor does it constitute an offer for sale.

Disclaimer

This Insight may provide information about Fund portfolios, including recent activity and performance and may contain facts relating to equity markets and our own interpretation. Any investment decision should take account of the subjectivity of the comments contained in the report. This Insight is provided for information only and all the information contained in it is believed to be reliable but may be inaccurate or incomplete; any opinions stated are honestly held at the time of writing but are not guaranteed. The contents of this Insight should not therefore be relied upon. It should not be taken as a recommendation to make an investment in the Funds or to buy or sell individual securities, nor does it constitute an offer for sale.