Guinness Global Energy Fund

The Guinness Global Energy strategy seeks capital growth through exposure to global energy markets.

Overview

The Guinness Global Energy Fund seeks capital growth through exposure to global energy markets.

We believe that over the next twenty years the combined effects of population growth, developing world industrialisation and diminishing fossil fuel supplies will force energy prices higher.

The world's population is growing at a rate of 1% per year and is projected to rise over the next 20 years by 1.5 billion people. Over 90% of this growth will come from developing countries. The implications for energy consumption are profound. In China and India, among the world's largest and fastest-growing economies, growing demand for electricity, cars and consumer goods will have a significant impact on the world's energy balance.

The rise in global energy demand is projected to continue long into the future. And it is highly likely that the majority of this demand will be met by mainstream energy sources like oil, natural gas and coal, supported by growth in renewable technologies.

Meanwhile, the risk that energy supplies fall short of what is required over the next few years is intensifying as, in particular, the era of low-cost, easily extractable oil comes to an end. The non-OPEC world, despite the success of shale oil in the US, struggles to grow production consistently. Any spare production capacity that OPEC countries may have today is likely to decline quickly as they respond to the expected rise in demand and shortfalls caused by events such as civil war or sanctions. Put simply, the oil industry faces a huge challenge to build up new supplies of oil to compensate for the rapid decline in existing fields.

The combination of growing demand and supply challenges signals that energy prices will move up over time. This would create a favourable environment for companies with energy reserves and for their service providers and distributors.

Investment Team

High quality funds are run by high quality people.

We are proud of our collegial culture, with teams across the business benefiting from each other’s expertise as they target long-term returns for investors.

Awards & Ratings

We have a firm commitment to delivering the very best. That commitment is reflected in the awards we have received, some of which are shown below.

Guinness Global Energy Fund

BEST FUND OVER 3 YEARS

Lipper - Equity Sector Natural Resources

Guinness Global Energy Fund

BEST COMMODITY FUND

Investment Week

How to Invest

We aim to make it simple to invest in our funds. All our funds are open to direct investment via an application form. They are widely available on investment platforms and are eligible for UK investors’ ISAs and SIPPs.

Investment Case

Our stock selection is driven 50% by our top-down (macro) views and 50% by bottom-up stock analysis.

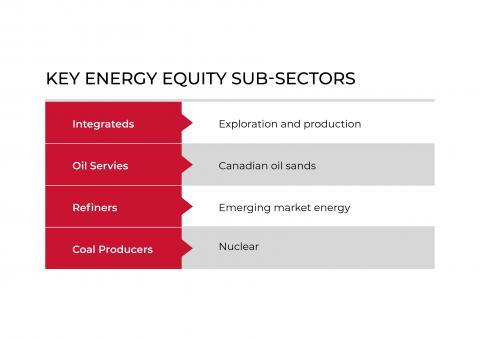

Rigorous independent analysis of the fundamental drivers of energy markets (e.g. oil supply and demand; OPEC behaviour; natural gas supply and demand; global LNG market; thermal and met coal markets). This allows us to forecast energy commodity prices and creates our top-down view, which in turn informs our energy sub-sector allocation.

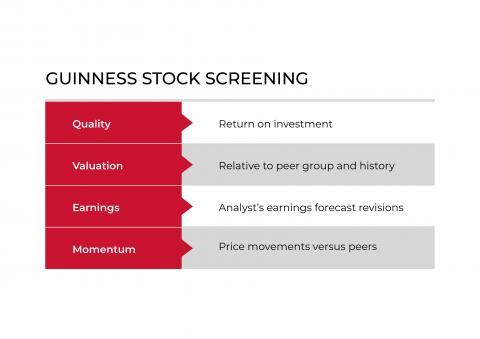

Stock ideas are derived from a disciplined stock screening process. We review a universe of around 370 energy stocks each week to identify companies which look attractive on valuation, return on investment, earnings sentiment, and price momentum. Other screens specific to certain sub-sectors are also employed. Due diligence is performed on our stock ideas to establish whether we have conviction to include the stock in our portfolio. The due diligence centres around detailed financial modelling.

The portfolio comprises 30 'best ideas' and does not follow any benchmark in its sub-sector weights, such as to ‘super-majors’. The portfolio is liquid, with 90% of the Fund normally invested in companies with a market capitalisation over US $1 billion.

In brief: why invest in energy?

In brief: why invest in energy?

Energy demand

Population growth and rising global wealth are driving relentless growth in the consumption of energy.

Energy supply

Despite improvements in alternative energy supplies, fossil fuels will remain the predominant world energy source for decades to come. However, the era of easily accessible, low-cost oil is over.

Energy company profits

Rising demand and depletion of low-cost energy supplies will push energy prices higher. This will create a favourable environment for companies with resource reserves, as well as their service providers and distributors.

Energy & inflation

Energy prices are a significant driver of inflation, which makes energy companies a useful long-term inflation hedge. If we see dollar inflation of 30-50% over the next decade (that’s just 2.7-4.3% per year), it will be surprising if oil and gas prices do not rise by a comparable percentage.

In detail: Energy Investment Case

“More motor vehicles will be sold over the next 20 years than have been sold in the entire history of the automobile industry.”

Supply is struggling to keep pace

High oil and natural gas prices between 2006 and 2014 incentivised energy companies to invest in new technologies, resulting in strong natural gas and oil production from unconventional shale resources in North America. This growth caused a change of production strategy from OPEC at the end of 2014, and this has led to sharply lower oil prices as OPEC grows production and defends market share while North American production starts to slow. We believe that OPEC is now producing near maximum capacity, while non-OPEC production will decline in the future as a result of lower investment levels. The industry still faces a big challenge in delivering reasonable oil supply growth at reasonable prices.

Favourable environment for investing in energy

The combination of growing demand and inadequate future supply signals that oil and other energy prices will move up over time. This would create a very favourable environment for companies with energy resources and for their service providers and distributors.

The Guinness Global Energy Fund seeks to capitalise on this energy price environment. We keep coming back to one key proposition: easily extractable oil and gas assets remain scarce, and it seems reasonable to believe that, as they get scarcer, they will trade at higher prices than we have yet seen. We believe shareholders in energy companies that are part of that world will be duly rewarded.

Surging demand for energy from developing countries

The world's population is growing at a rate of 1% per year, and is projected by the UN to rise by a further 20% (1.5 billion people) by 2030. Over 90% of this growth will come from developing countries. The implications for energy consumption are profound.

More motor vehicles will be sold over the next 20 years than have been sold throughout the entire history of the automobile industry. The surge of demand for electricity, cars and consumer goods in emerging markets will have a significant impact on the world's energy balance. China’s demand for oil per capita has not yet reached that of the OECD in 1950. There are 20 years of unrelenting oil demand growth to come as China’s vehicle fleet moves from 100 million now to 400 million by 2030, with numerous other countries following behind.

The rise in global energy demand is projected to continue long into the future. It is likely that the majority of this demand will be met by mainstream energy sources like oil, natural gas and coal.

The world’s oil consumption currently stands at around 94 million barrels per day, and continues to reach new highs each year. Even in the global recession of 2008/09, demand for oil from emerging markets continued to grow. We think that, over the next 10 years, global oil demand growth of 10-15 million barrels per day is highly plausible.

Investment process

Our stock selection is driven 50% by our top-down (macro) views and 50% by bottom-up stock analysis. The top-down views shape our energy sub-sector allocation, whilst bottom-up analysis is designed to identify the best stocks to populate our sub-sector allocation. The investment team applies a mixture of value and growth investing, with a bias towards value.

Top-down views

Rigorous independent analysis of the fundamental drivers of energy markets (e.g. oil supply and demand; OPEC behaviour; natural gas supply and demand; global LNG market; thermal and met coal markets). This allows us to forecast energy commodity prices and creates our top-down view, which in turn informs our energy sub-sector allocation.

Bottom-up stock screening

The team operates a disciplined stock screening process. We review a universe of around 370 energy stocks each week to identify companies which look attractive on valuation, return on investment, earnings sentiment, and price momentum. Other screens specific to certain sub-sectors are also employed to generate ideas.

Stock due diligence

Stock ideas are taken from our screens and due diligence is performed to establish whether we have conviction to include the stock in our portfolio. The due diligence centres around detailed financial modelling.

Portfolio Construction

Concentrated portfolio

The portfolio comprises 30 equally-weighted positions. Most of the positions comprise a single stock but a few are split across more than one stock, giving the portfolio 40-45 stocks in total. Our portfolio construction, with a fixed number of positions, is designed to create the best balance between maintaining fund concentration and managing stock-specific risk. It also imposes a structural sell discipline: an existing position must be sold to purchase a new holding.

Sector weights

The Fund does not follow any benchmark in its sub-sector weights. In particular, there are no underweight restrictions; the “super-major” oil and gas sector weighting may be zero.

Portfolio Risk Controls

Stock specific risk

Stock specific risk in the energy sector tends to be higher than the broader market. Our portfolio is designed to avoid excessive exposure to any individual stock.

Emerging market exposure

Normal practice is that emerging market exposure (considered by listing and by underlying asset exposure) is limited to 20% of the Fund.

Liquidity

The portfolio is liquid, with 90% of the Fund normally invested in companies with a market capitalisation over US $1 billion.

Currency

The Fund is not hedged from a currency perspective. However, because the underlying investments have an exposure to energy commodity prices, this tends to act as a natural hedge against currency movement.

Updates

KIIDS

| Fund | Class | ISIN | English | French | German | Spanish | Italian | Swedish | Finnish |

|---|---|---|---|---|---|---|---|---|---|

| Guinness Global Energy Fund | Y USD Dist | IE00BG6L7638 | Download | ||||||

| Guinness Global Energy Fund | C CNH Hedged Dist | IE000P8HSFB7 | Download | ||||||

| Guinness Global Energy Fund | C EUR Acc | IE00BGHQF524 | Download | ||||||

| Guinness Global Energy Fund | C GBP Acc | IE00B3CCJ963 | Download | ||||||

| Guinness Global Energy Fund | C USD Acc | IE00B2Q91V27 | Download | ||||||

| Guinness Global Energy Fund | D EUR Acc | IE00B3CCJB88 | Download | ||||||

| Guinness Global Energy Fund | D USD Acc | IE00B2Q91T05 | Download | ||||||

| Guinness Global Energy Fund | I USD Acc | IE00BMYPN507 | Download | ||||||

| Guinness Global Energy Fund | Y EUR Acc | IE00BFMGVR44 | Download | ||||||

| Guinness Global Energy Fund | Y GBP Acc | IE00B6XV0016 | Download | ||||||

| Guinness Global Energy Fund | Y USD Acc | IE00B3CCJC95 | Download |

KIDS

| Fund | Class | ISIN | English | French | German | Spanish | Italian | Swedish | Finnish |

|---|---|---|---|---|---|---|---|---|---|

| Guinness Global Energy Fund | D USD Acc | IE00B2Q91T05 | Download | Download | Download | Download | Download | Download | Download |

| Guinness Global Energy Fund | C USD Acc | IE00B2Q91V27 | Download | Download | Download | Download | Download | Download | Download |

| Guinness Global Energy Fund | C GBP Acc | IE00B3CCJ963 | Download | Download | Download | Download | Download | Download | |

| Guinness Global Energy Fund | D EUR Acc | IE00B3CCJB88 | Download | Download | Download | Download | Download | Download | Download |

| Guinness Global Energy Fund | Y USD Acc | IE00B3CCJC95 | Download | Download | Download | Download | Download | Download | Download |

| Guinness Global Energy Fund | Y GBP Acc | IE00B6XV0016 | Download | Download | Download | Download | Download | Download | |

| Guinness Global Energy Fund | Y EUR Acc | IE00BFMGVR44 | Download | Download | Download | Download | Download | Download | Download |

| Guinness Global Energy Fund | Y USD Dist | IE00BG6L7638 | Download | Download | Download | Download | Download | Download | |

| Guinness Global Energy Fund | C EUR Acc | IE00BGHQF524 | Download | Download | Download | Download | Download | Download | Download |

| Guinness Global Energy Fund | C CNH Hedged Dist | IE000P8HSFB7 | Download | Download | Download | Download | |||

| Guinness Global Energy Fund | I USD Acc | IE00BMYPN507 | Download | Download | Download | Download |

Documents

Fund Facts

For information on the Fund’s current investments, please see the latest factsheet available on the literature tab above.

The Guinness Global Energy strategy is also available to UK investors as a UK-domiciled vehicle denominated in GBP: the WS Guinness Global Energy Fund.

Will Riley (30/06/2010)

Jonathan Waghorn (09/09/2013)

Share Classes

For full information on the share classes available for investment please refer to the Key Investor Information document.

Share Prices

The Funds are priced every working day at 23.00 Dublin time and updated here the following day.

Guinness Global Energy Fund - Webcast - Covering Q4 2022

Tim Guinness on Citywire Funds Fanatic podcast: asset management through boom and bust

Guinness Global Energy Fund - Webcast - Covering Q3 2022

Fidelity Podcast: Are energy price rises here to stay?

Guinness Global Energy Fund - Webcast - Covering Q2 2022

Guinness Global Energy Fund - Webcast - Covering Q1 2022

Guinness Global Energy Fund is an equity fund. Investors should be willing and able to assume the risks of equity investing. The Fund invests only in companies involved in the energy sector; it is therefore susceptible to the performance of that one sector, and can be volatile. The value of an investment and the income from it can fall as well as rise as a result of market and currency movement; you may not get back the amount originally invested. For full information on the risks, please refer to the Prospectus, Supplement, and KID/KIID for the Fund, which are available on our website (guinnessgi.com/literature). If you decide to invest, you will be buying units/shares in the Fund and will not be investing directly in the underlying assets of the Fund. Past performance does not predict future returns.

Source: FE fundinfo. Net of fees. Investors should note that fees and expenses are charged to the capital of the Fund. This reduces the return on your investment by an amount equivalent to the Ongoing Charges Figure (OCF). The OCF for the Y share class is 0.99%. Returns for share classes with a different OCF will vary accordingly. Transaction costs also apply and are incurred when a fund buys or sells holdings. The performance returns do not reflect any initial charge; any such charge will also reduce the return.