How consumers are driving emerging markets’ future

Emerging markets have been weighed down in the post-covid period by China’s economic slowdown. However, when the Politburo announced economic stimulus measures in September, the market reaction was swift. Although positive, shorter-term developments such as this – and even the US presidential election – shouldn’t distract investors unduly from some of the longer-term trends in emerging markets. One of the most significant is the growth in consumption being driven by higher incomes and growing wealth.

Demographic tailwinds

About two-thirds of the global population lives in emerging markets. As consumers, they present a huge opportunity, being a potential market of 5 billion users of products and services. Furthermore, they are becoming younger on average, with projections indicating that by 2030 75% of consumers in emerging markets will be between the ages of 15 and 34, which is significant because of this demographic’s optimism about the economy and greater willingness to spend compared to developed market peers.

As managers of the Guinness Emerging Markets Equity Income Fund, the three aspects of these trends we find most relevant are:

- Growing incomes driving high consumption.

- More premium consumption, especially in Asia.

- The quality stock opportunities this creates in a variety of regions.

Growth in consumption

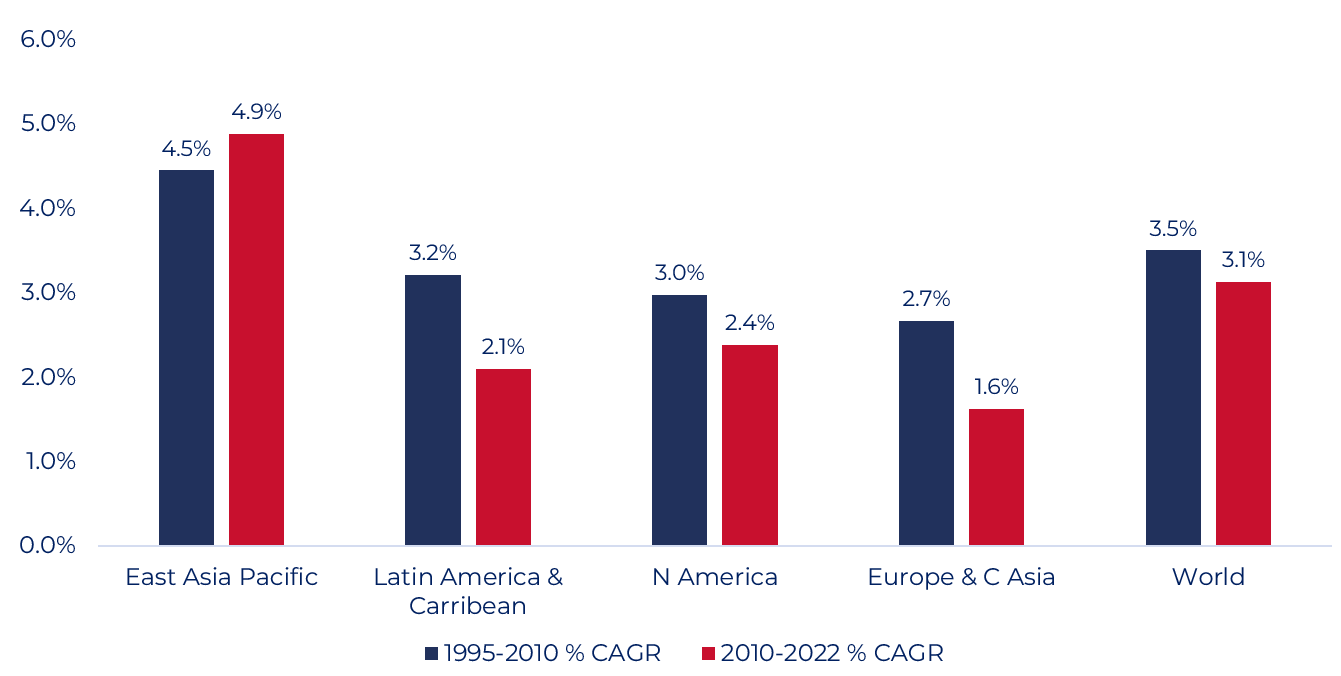

Emerging markets account for the majority of volume growth for consumer products companies and serve as the primary source of future volume growth potential. Asia in particular has seen the fastest increase in house consumption expenditure, rising from 4.5% annually before 2010 to 4.9% since, as the chart below shows:

Source: Household & NPISH Final Consumption PPP (Constant 2021 Intl $) . International Comparison Program, World Bank | World Development Indicators database, World Bank | Eurostat-OECD PPP Programme..

Consumers are shifting towards global brands, especially in India, and are opting for premium products, a trend seen in India and the Middle East. While China remains a key consumer market, the current picture is mixed due to subdued consumer confidence. Latin America has shown strong consumption growth, although this trend leans more towards everyday products, with consumers generally less inclined to trade up. Accordingly, within the portfolio, higher-end consumption trends are typically more associated with the Asian holdings. (Note not all of the companies mentioned below are held in the Guinness Emerging Markets Equity Income portfolio – some are included for illustration purposes.)

Growth in demand for premium products – especially in Asia

Asian economies have developed through a two-step process. They nurture and protect large manufacturing industries until they achieve sufficient scale. Once established, these companies are encouraged to compete on a global scale. Companies need to reach sufficient scale to compete effectively, while competition itself drives quality improvements that meet Western standards. However, the trend we are seeing emerge, the demand for improved quality, is increasingly coming from domestic consumers within Asian and emerging markets.

An example is BYD, a Chinese electric vehicle (EV) manufacturer, which is positioned to satisfy consumer demands at both ends of the quality spectrum. Its Seagull model, priced at $9,700, has received positive reviews for its simple but efficient design and unexpectedly high quality and reliability, allowing it to compete in a growing EV market. BYD also addresses the luxury segment through its YANGWANG brand, which recently launched its first pure electric supercar priced at $233,000, offering performance comparable to well-established supercar brands.

BYD Seagull, retailing for $9,700, and the BYD WANGYANG U9, retailing for $233,000. (Left image source: BYD, Right image source: Getty Images | Bloomberg)

In the technology sector, the Huawei Mate 60 smartphone uses advanced chips produced by SMIC, positioning it as a strong competitor to Apple in the domestic market. Haier Smart Home is known for its smart home appliances, such as refrigerators, freezers, and washing machines. Haier's success can be attributed from a strong ecosystem of brands, the interoperability across its product lines, and its ability to segment brands than span various price points. Moreover, Haier's acquisition of GE Appliances in the U.S. has contributed to its global expansion strategy and is reminiscent of Lenovo's strategy of acquiring the ThinkPad brand from IBM.

Growing wealth as a springboard for higher consumption

Growing wealth has been a significant driver of demand for luxury and branded products. Kweichow Moutai is a leading producer of Baijiu spirits in China. Its flagship product, the Flying Fairy, priced at $380 per 500ml, represents high-end consumption. Despite challenging macroeconomic conditions in China, the prestige with which the product is associated has helped Moutai to achieve strong pricing power. Furthermore, Kweichow Moutai is attempting to shift towards a direct-to-consumer (D2C) model with the effect of increasing margins. With high returns and a meaningful dividend payout, we believe it represents an attractive investment. Similar pricing power trends can also be found within some of the luxury brands of companies based in developed markets, such as LVMH and Richemont.

Kweichow Moutai’s Flying Fairy (Image source: Selfridges)

In the dairy sector, Yili is China's leading domestic company, offering a range of branded consumer products such as fresh and UHT milk, powdered milk, yoghurt and cheese. Yili benefits from two powerful tailwinds: its strong market position and brand recognition, which creates pricing power; and increasing per capita demand for dairy products over time. The combination of these tailwinds will, we believe, be highly supportive of demand over time.

How companies in Emerging Markets are gaining exposure

Direct exposure

In India, we hold Bajaj Auto, a motorcycle manufacturer with strong domestic market presence. Bajaj is quickly gaining market share in the EV sector and has capitalised on India's Production Linked Incentives (PLI) scheme to boost local manufacturing. Its acquisition of the Triumph motorcycle brand has also positioned it to cater to high-end consumer demands. Additionally, Bajaj has opened a facility in Brazil, establishing a significant presence in what it expects to be one of its largest international markets, and highlights the role that emerging markets play, both as drivers of consumer demand and sources of production. The company is also implementing a stock buyback programme to return excess cash to investors.

Hypera Pharma is a leading Brazilian consumer pharmaceutical company with strong market positions across various health categories, including analgesics, gastroenterological products, foot care, and vitamins, partly achieved by strategic acquisitions of strong brands. Despite macroeconomic uncertainties and the company facing temporary challenges with inventory, Hypera is a cash-generative company that is likely to benefit from rising household incomes and strong consumer demand over time.

Hypera Pharma (Image source: DPI Distribuidora)

Indirect exposure

Indirect exposure can be seen in Brazil's financial services sector through holdings Porto Seguro SA, an auto insurer, and B3 SA Brasil Bolsa Balcao, a financial market infrastructure company with part of its business linked to vehicle finance registration. Both benefit from greater vehicle ownership, and higher spending on vehicles over time.

In the banking sector, we hold stakes in banks focused on consumer segments (business areas including consumer loans, wealth management, and credit cards,) such as China Merchants Bank, Bank Rakyat in Indonesia with its micro-lending services, TISCO in Thailand with its expertise in hire purchasing, and DBS in Singapore with its strong wealth management franchise. Additionally, indirect exposure is achieved in the industrial sector through our tool makers, such as Haitian, which produces injection-moulding machines for consumer product manufacturing. Haitian has also been a beneficiary of the rejigging and reordering of supply chains that has been occurring over recent years.

Multi-country exposure

Companies with regional or multi-country exposure offer access to markets beyond their country of listing. Greek-listed Jumbo, a retailer of toys, baby items, and stationary, is tapping into some of the fastest growing Eastern European markets like Romania, Bulgaria, and Cyprus, balancing e-commerce with bricks-and-mortar retail while maintaining good control of overheads and inventory.

Arca Continental, a Mexican company added to the fund this year, operates in Mexico, Peru, Ecuador, and Argentina. As one of the top five Coke bottlers globally and second in Latin America to Coca-Cola Femsa, Arca benefits from Coca-Cola's strong market share, notably its 50% volume share of the soft drink market in Mexico, compared to PepsiCo's 9%. The company enjoys significant scale advantages, enhancing manufacturing and distribution efficiency and lowering advertising costs, and benefits from improved infrastructure and transportation, which facilitate access to new markets.

With some markets having relatively low levels of consumption, rising incomes and moderating inflation can help drive volume demand. For example, countries such as Peru, where per capita consumption is at 25% the level of that in Mexico, present an opportunity for volume growth. The introduction of no- and low- sugar beverages and ready-to-drink alcoholic drinks will also broaden their product range.

Unilever Indonesia is one of the largest consumer goods companies in the country, holding a top-three market share in its categories with brands like Pepsodent, Dove, Rexona, Vaseline. The country is benefitting from key trends affecting consumer behaviour in emerging markets, including a growing middle class and increased urbanisation. To illustrate the growth in the middle class, in 2005 68% of households earned less than $1.5K, while 12% earned between $2.5K and $10K. By 2022, only 19% earned less than $1.5K, and 52% fell into the $2.5K and $10K range. Advertising expenditure is shifting from the traditional to digital channels, especially social media. Indonesia ranks second globally in TikTok users, behind China, with 158 million people spending an average of 38 hours per month on the platform, compared to 121 million in the U.S. This user base is predominantly younger. If sustained GDP growth continues, FMCG (fast-moving consumer goods) companies like Unilever Indonesia may see a repeat of double-digit growth from the early 2000s.

How does this all contribute to the developments across Emerging Markets?

Emerging Markets are a major source of potential growth with a consumer demographic that is young and getting younger whose increasing wealth has correlated not only with increased domestic consumption habits, but with a demand for quality, premium brands with more favourable profit margins at the local level.

How we invest in Emerging Markets

A balance of direct and indirect exposure to Emerging Markets in a variety of industries allows the Guinness Emerging Markets Equity Income Fund to benefit from the high growth potential available in developing economies (as both disposable income grows and consumption habits change) while minimising stock-specific risk and the impact of market volatility.

Read more about the Guinness Emerging Markets Equity Income Fund

Disclaimer: This Insight may provide information about Fund portfolios, including recent activity and performance and may contains facts relating to equity markets and our own interpretation. Any investment decision should take account of the subjectivity of the comments contained in the report. This Insight is provided for information only and all the information contained in it is believed to be reliable but may be inaccurate or incomplete; any opinions stated are honestly held at the time of writing but are not guaranteed. The contents of this Insight should not therefore be relied upon. It should not be taken as a recommendation to make an investment in the Funds or to buy or sell individual securities, nor does it constitute an offer for sale.