Loshini SubendranThe Magnificent Seven describes a group of high performing tech stocks. Microsoft, Apple, NVIDIA, Alphabet, Amazon, Meta and Tesla, which over the past year have surged ahead of the market, driving the S&P 500 to all time highs. And now, based on the largest market capitalisations in the world.

Such high performance and resilience, particularly in this higher for longer interest rate environment, has unsurprisingly caught the attention of the market and investors.

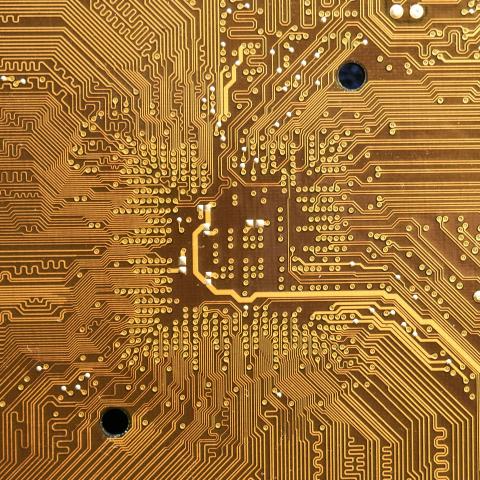

Arguably the catalyst of their growth has been the emergence and acceleration in generative artificial intelligence and large language models, and we believe each company is uniquely positioned towards these secular growth themes, among others.

At Guinness, we hold six of these seven stocks, all but Tesla across our

Global Equity Income and

Global Innovators funds. We believe these six companies hold underlying business quality, are exposed to long lasting secular growth themes and thus offer an attractive investment.

We can see this in the case of NVIDIA, as the company is at the forefront of artificial intelligence. That state-of-the-art proprietary GPU's offering such cutting edge chips has enabled the company to hold more than 90% market share of the GPU's required for generative AI systems and thus maintain a wide economic moat. Similarly, the tech and cloud giants Microsoft, Amazon and Alphabet were early movers in developing their cloud computing capabilities with their respective products, Azure, Amazon Web Services, and Google Cloud products with well established software that offers a host of services such as cloud storage. All three dominate the cloud market and are well positioned to capture the growing uses of power computing.

Although the future returns of these stocks cannot be predicted, our investment in six out of the Magnificent Seven stocks remains grounded in our

investment philosophy of using bottom up stock select selection to invest in high quality companies that are exposed to long lasting secular growth themes.