The Price-to-Earnings (P/E) Ratio Explained

What is the P/E Ratio?

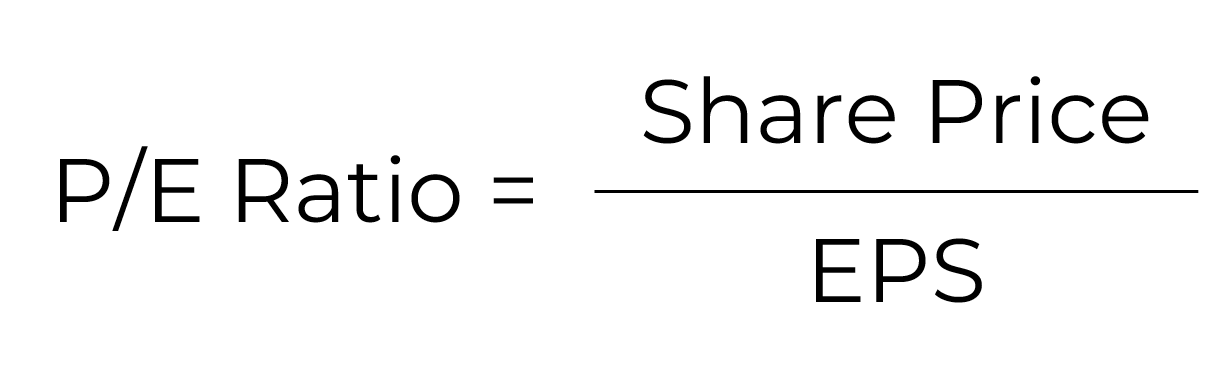

The Price to Earnings (P/E) ratio expresses a firm’s share price compared to its Earnings Per Share (EPS), helping investors assess whether a firm is over- or under-valued relative to its profitability. A higher P/E ratio may indicate that investors expect strong future growth, while a lower P/E ratio could suggest a less positive view of a company's prospects. As with the share price and earnings figures themselves, however, there are many factors which can affect the P/E ratio. On its own, without the market and company-specific context, a P/E ratio doesn’t tell us very much, and it should not be relied upon in isolation when making investment decisions.

The share price of a listed company varies almost constantly due to market movement as investors buy and sell shares.

Earnings per share (EPS) shows us how much profit is accrued to each share and is a key indicator of profitability.

Example of P/E ratio

Firm A has a share price of £30 and an EPS of £1.50, while Firm B has a share price of £35 and an EPS of £2.50.

Firm A P/E (30/1.5) = 20

Firm B P/E (35/2.5) = 14

Industry average P/E = 17

A P/E Ratio of 20 means that Firm A has a market value that is 20 times its annual earnings. One way to think about this is that it would take Firm A 20 years to 'earn back' your initial investment.

While Firm B has a higher share price than Firm A, it also has a lower P/E ratio than Firm A. This makes Firm B 'cheaper' in P/E terms, as you are paying less for every pound or dollar in profit. However, this does not mean that Firm B is necessarily the better investment of the two.

High vs low P/E ratios

Firm A’s higher P/E ratio compared to the industry standard can indicate that investors, expecting earnings to grow, have been buying up its shares. This increases its share price and, by extension, the P/E ratio. In 'style' terms, it might be considered a 'growth' stock (high growth potential but increased risk), but could also be seen as being overvalued (depending on the investor’s assessment).

Firm B, with its lower P/E ratio, could be considered a 'value' stock (lower levels of growth with reduced risk). An investor with a more optimistic view of Firm B's future earnings might consider it undervalued and buy its shares in the expectation that these higher future earnings will be realised. However, a low P/E ratio can also indicate the firm is underperforming and the undervaluation is illusory.

Industry average P/E Ratios

Context is important in assessing if a company has a relatively high or low P/E ratio. As well as different growth prospects, industries have more or less variation or cyclicality in their profitability. Meanwhile, the price component of the P/E ratio is affected by the full range of factors inherent in market prices including capital flows, monetary conditions, economic growth, and so on. 'Hype' surrounding whole industries can ebb and flow, leading to large fluctuations in P/E ratios, while, on the other hand, marked differences between industry average P/Es can persist.

For example, according to full:ratio, the US-based semiconductor industry has a P/E ratio average of 37.9, while broadcasting companies have an average P/E ratio of 12.3 (as of August 2025). The semiconductor industry has been growing rapidly in recent years, and it would seem from this relatively high valuation that investors expect it to continue to do so. The valuation of broadcasting companies reflects a more mature industry with slower expected growth. Which industry will deliver the more rewarding investment over the next five years depends, however, not just on whether the earnings expectations for each are met, but also on how investors value the shares.

Types of P/E ratio

The P/E ratio is complicated by the different ways of calculating EPS. The main distinction is between backward and forward-looking earnings. 'Forward' P/E ratios are based on consensus earnings forecasts of market analysts, while 'trailing' or 'trailing twelve month' P/E uses actual reported earnings over the last full year, or 12 months if data is available.

Limitations of the P/E Ratio

The P/E ratio can also be distorted by several factors. Earnings information is presented by the company itself, and although listed companies have to meet strict accounting requirements, they can take opportunities to marginally distort EPS and thus the P/E ratio. Additionally, if a company has negative EPS (meaning the company isn’t profitable and has lost money over the period), the P/E ratio becomes negative, rendering it not meaningful.

A company’s balance sheet can also affect the P/E ratio. Increased debt can lead to a lower share price as investors weigh up the debt burden, but the cost of the debt might not affect earnings to the same degree, distorting the P/E ratio – particularly if the company uses debt to buy back shares. On the other hand, debt can be an effective vehicle for growth.

While the P/E ratio is a useful tool for assessing and comparing the value of a company, the variety of interpretations that can stem from it and the ways it can be distorted mean it is of little use in isolation.

The P/E ratio must be considered alongside the firm's earnings profile and its valuation. There are many techniques which build on the P/E ratio such as by comparing it to a company's earnings growth or by attempting to adjust for market cycles.

How Asset Managers use the P/E Ratio

At Guinness Global Investors our investment team assesses and compares P/E ratios as part of detailed valuation analysis of hundreds of companies before making investment decisions. Click here to learn more about the investment philosophy underlying our approach.

Learn about Dividend Yield Vs Total Return

The value of this investment can fall as well as rise as a result of market and currency fluctuations. You may not get back the amount you invested.

This is a marketing communication. Please refer to the prospectus, supplement and KID/KIID for the Funds, which contain full information on the risks and detailed information on their characteristics and objectives, before making any final investment decisions.

This Insight may provide information about Fund portfolios, including recent activity and performance and may contain facts relating to equity markets and our own interpretation. Any investment decision should take account of the subjectivity of the comments contained in the report. This Insight is provided for information only and all the information contained in it is believed to be reliable but may be inaccurate or incomplete; any opinions stated are honestly held at the time of writing but are not guaranteed. The contents of this Insight should not therefore be relied upon. It should not be taken as a recommendation to make an investment in the Funds or to buy or sell individual securities, nor does it constitute an offer for sale.