Impact Report 2024: Sustainable Energy

The Guinness Sustainable Energy strategy invests in companies playing a key role in global decarbonisation, providing a vehicle for investors to align their capital with this positive impact.

This is the sixth iteration of this report based on 2023 data detailing:

- The positive decarbonising impact of the companies held in the portfolio

- Alignment portfolio company activities with respect to the UN Sustainable Development Goals (SDGs)

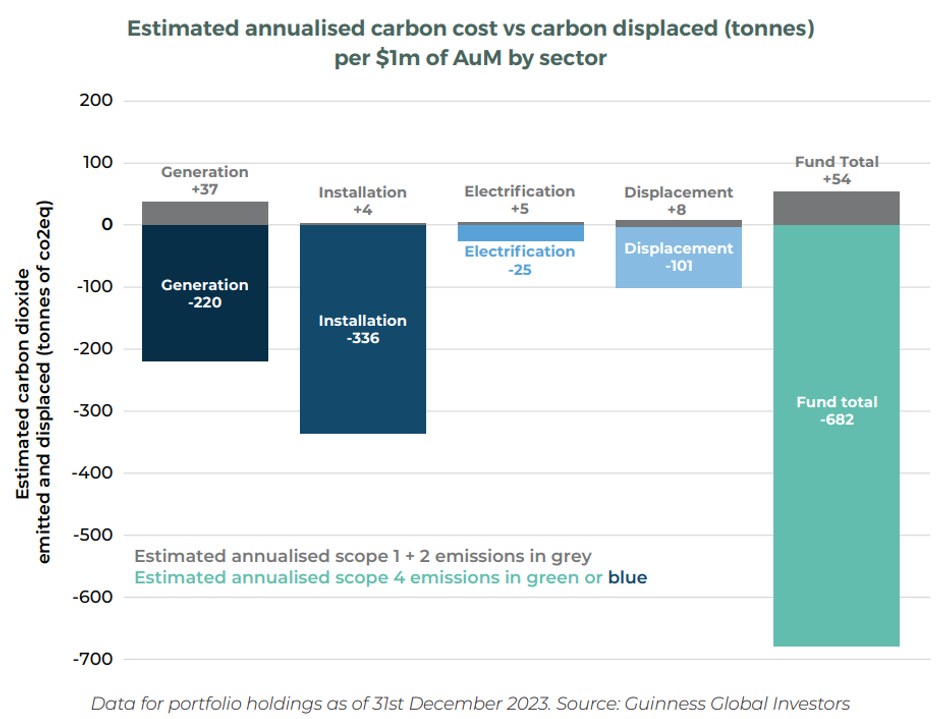

Our headline finding was that the companies in our portfolio sold products and services that help to displace 682 tonnes of CO2e per USD$1m of portfolio assets. To put this into context, 682 tonnes of carbon dioxide is equivalent to planting around 11,300 tree seedlings, providing energy for 89 homes, driving 1.74m miles, or using 1,580 barrels of oil.

We note that our headline figure of 682 tonnes of CO2e is higher than last year’s figure of 527 tonnes of CO2e. The main driver behind this was the year-on-year increase in positive impact activity, followed by changes in valuation and market capitalisation.

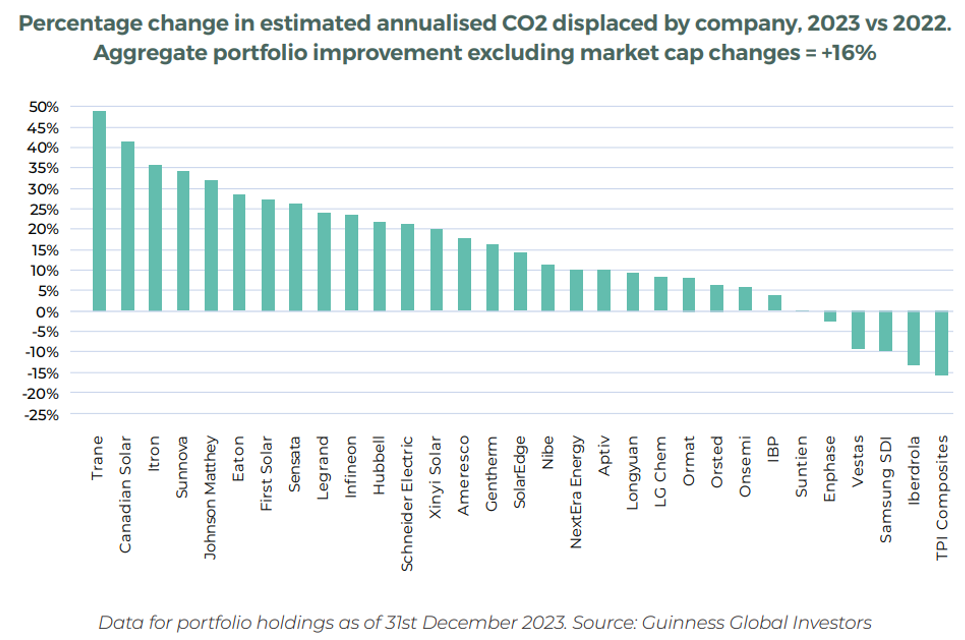

To strip out the noise created by changes in holdings, weights and market capitalizations, we also consider the aggregate positive impact of companies owned in the portfolio (the carbon displaced if we owned 100% of all companies in the strategy). We found that the aggregated positive impact of our portfolio increased +16% yoy.

This improvement primarily came from our installation names selling more wind, solar and energy management products than last year, combined with our generation names producing more wind and solar power than last year.

Impact at Company Level

We consider the impact at a company level, looking at those companies that grew their positive impact by the most, and exploring why positive impact fell for some companies.

In all cases where positive impact fell, we believe that this was due to temporary fluctuations, calculation changes, or one-offs rather than any deviation in corporate strategy. We are satisfied that companies are still on track to deliver a positive environmental impact by growing revenues and profits from climate solutions.

For clients wanting more detail on negative impacts, we include a case study on a company with both positive and negative impacts (China Longyuan) and a worked example of positive and negative impact calculation (Vestas).

UN Sustainable Development Goal Alignment

With regard to alignment with the UN’s Sustainable Development Goals, our analysis demonstrates that we contribute most directly to SDGs 7, 9, 11, and 13:

- SDG 7 – Affordable and clean energy: Displacement & Generation companies

- SDG 9 – Industry, innovation and infrastructure: Installation companies

- SDG 11 – Sustainable cities and communities: Electrification companies

- SDG 13 – Climate action: Collectively, these companies provide the products and services which allow governments to integrate climate measures into national policies, strategies and planning

We believe that we analyse our alignment the SDGs using a methodology that is more thorough than most employ. However, a large number of funds -sustainable or not - are linking their funds to the SDGs. To avoid be allegations of ‘greenwashing’, we can emphasise that we link the companies’ divisional business activity to one of the 160+ targets which sit under the 17 SDGs (see the report’s Appendix) and back this up with our carbon emission displacement work.

Our Engagement Framework

We also discuss our engagement framework (disclosure, target setting, incentivisation).

- Disclosure: We ask for a risk / opportunity to be measured and disclosed (e.g. CO2 emissions, green sales)

- Target setting: We then ask for a target to be set (e.g. net zero by 2050, x% green sales by 2025)

- Incentivisation: Finally, we ask for such targets to be linked to executive remuneration to ensure it is more likely to be achieved (e.g. 10% of the annual bonus is linked to emissions reduction / growing green sales)

We provide case studies of our engagements with China Suntien, Infineon, Itron, and policy engagement via UKSIF

- China Suntien, encouraging them to disclose to CDP

- Infineon, asking them to register their emissions reduction target with the science based targets initiative (SBTi)

- Itron, engaging with them to link their robust emissions reduction targets to executive remuneration

- UK climate policy engagement via our UKSIF membership

This is the first time we have included case studies relating to our collective and policy engagement initiatives.

Climate-related Initiatives

We also have a section discussing broader climate-related initiatives that we are involved in. As a reminder, we are involved with:

- Climate Action 100+ (CA100+)

- The largest collective investor engagement initiative on climate change

- CDP’s non-disclosure campaign

- A collective initiative seeking to improve corporate climate disclosure

- The Investor Agenda’s Global Investor Statement

- A statement to global governments urging them to radically step up their climate ambitions

- The World Benchmarking Alliance’s (WBA) Investor Letter and Investor Statement on Just Transition

- The Just Transition seeks to ensure workers are not left behind in the energy transition.

- These initiatives asked 100 oil and gas companies for better Just Transition disclosures and signalled to them the importance investors are putting on the Just Transition.

- UK Sustainable Investment and Finance Association (UK SIF)

- A membership association for UK sustainable finance and a conduit for climate policy engagement.

Disclaimer

This Insight may provide information about Fund portfolios, including recent activity and performance and may contain facts relating to equity markets and our own interpretation. Any investment decision should take account of the subjectivity of the comments contained in the report. This Insight is provided for information only and all the information contained in it is believed to be reliable but may be inaccurate or incomplete; any opinions stated are honestly held at the time of writing but are not guaranteed. The contents of this Insight should not therefore be relied upon. It should not be taken as a recommendation to make an investment in the Funds or to buy or sell individual securities, nor does it constitute an offer for sale.